Pitney Bowes 2007 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2007 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10

ITEM 7. – MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS

Management’ s Discussion and Analysis of Financial Condition and Results of Operations (MD&A) contains statements that

are forward-looking. These statements are based on current expectations and assumptions that are subject to risks and

uncertainties. Actual results could differ materially because of factors discussed in Forward-Looking Statements and

elsewhere in this report.

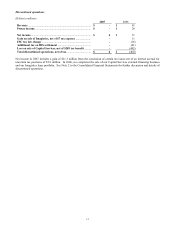

Overview

Revenue grew 7% in 2007 to $6.1 billion. Acquisitions and foreign currency translation contributed about 4% and 2%,

respectively to this growth. Acquisitions for this year included MapInfo Corporation, Digital Cement, and Asterion SAS.

Income from continuing operations was $361 million in 2007 compared with $566 million in 2006 and diluted earnings per

share from continuing operations was $1.63 in 2007 compared with $2.51 in 2006. In 2007, diluted earnings per share from

continuing operations was reduced by restructuring and impairment charges of 87 cents, 5 cents for the purchase accounting

alignment for MapInfo, and 16 cents for tax adjustments, related principally to a valuation allowance for net operating losses

outside the U.S. In 2006, diluted earnings per share from continuing operations was reduced by restructuring charges of 10

cents and tax adjustments of 9 cents and increased by 1 cent from net legal settlements.

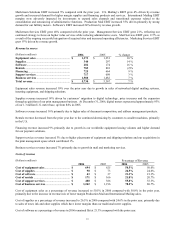

Our Software and Mail Services segments experienced strong results during 2007. These strong performances were offset by

disappointing results in Europe, weaker performance in the legal solutions portion of our Management Services segment, and

lower sales at U.S. Mailing due to the wind-down of meter migration. In addition, weakness in certain sectors of the

economy, such as financial services, adversely affected our results during the second half of 2007.

On November 15, 2007, we announced a plan to lower our cost structure, accelerate efforts to improve operational

efficiencies, and to transition our product line. As a result of this program, we expect a net reduction of about 1,500 positions

across business lines and geographies, representing approximately 4 percent of the global employment base. Also, following

a comprehensive review of our portfolio, we decided to explore strategic alternatives to determine the best course of action

for our U.S. Management Services business.

See Results of Operations for 2007, 2006 and 2005 for a more detailed discussion of our results of operations.

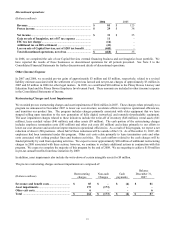

Outlook

We believe that the actions we took in the fourth quarter of 2007, and actions that we will continue to take in 2008, will

position us for sustained, long-term improvement in earnings and increased shareholder value. We expect to realize

approximately $70 million in pre-tax annual benefits from these actions in 2008. We intend to reinvest the majority of these

benefits in programs to improve our customers’ experience and our operational efficiencies. We are targeting $150 million in

pre-tax annual benefits by 2009. We plan to use about half of these benefits to improve customer processes and generate

revenue.

We expect our mix of revenue to continue to change, with a greater percentage of revenue coming from diversified revenue

streams associated with fully featured smaller systems and a smaller percentage from larger system sales. We also expect a

greater percentage of revenue growth from the Software and Mail Services segments. In addition, we expect to derive further

synergies from our recent acquisitions. We will continue to remain focused on enhancing our productivity and to allocate

capital in order to optimize our returns.