PG&E 2013 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2013 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (Continued)

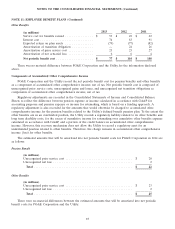

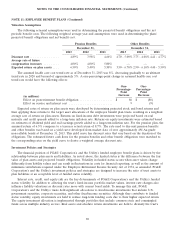

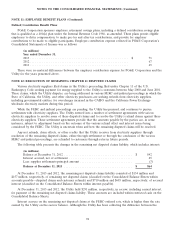

NOTE 11: EMPLOYEE BENEFIT PLANS (Continued)

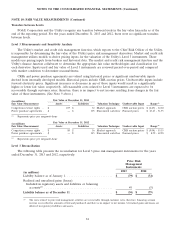

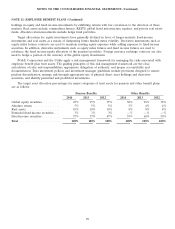

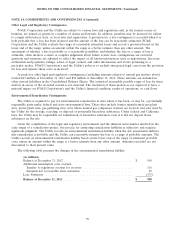

Fair Value Measurements

The following tables present the fair value of plan assets for pension and other benefits plans by major asset

category at December 31, 2013 and 2012.

Fair Value Measurements

At December 31,

2013 2012

Level 1 Level 2 Level 3 Total Level 1 Level 2 Level 3 Total

(in millions)

Pension Benefits:

Money market

investments ..... $ 70 $ — $ — $70$112$—$—$ 112

Global equity

securities ....... 1,123 2,363 — 3,486 402 3,017 — 3,419

Absolute return .... — — 554 554 — — 513 513

Real assets ....... 562 — 544 1,106 525 — 285 810

Fixed-income

securities:

U.S. government . 1,281 319 — 1,600 1,576 139 — 1,715

Corporate ...... 1 4,230 625 4,856 3 4,275 611 4,889

Other ......... 166 555 — 721 — 576 — 576

Total ........... $ 3,203 $ 7,467 $ 1,723 $ 12,393 $ 2,618 $ 8,007 $ 1,409 $ 12,034

Other Benefits:

Money market

investments ..... $ 31 $ — $ — $31$ 77$ —$ —$77

Global equity

securities ....... 127 504 — 631 118 397 — 515

Absolute return ....——5353 ——4949

Real assets ....... 67 — 38 105 68—2896

Fixed-income

securities:

U.S. government . 119 5 — 124 148 5 — 153

Corporate ...... 4 894 2 900 9 795 1 805

Other ......... 14 37 — 51 —38—38

Total ........... $ 362 $ 1,440 $ 93 $ 1,895 $ 420 $ 1,235 $ 78 $ 1,733

Total plan assets at

fair value ....... $ 14,288 $ 13,767

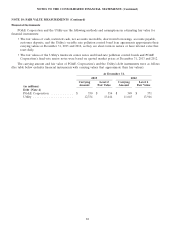

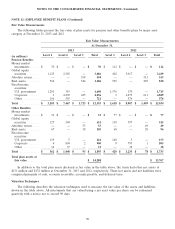

In addition to the total plan assets disclosed at fair value in the table above, the trusts had other net assets of

$131 million and $132 million at December 31, 2013 and 2012, respectively. These net assets and net liabilities were

comprised primarily of cash, accounts receivable, accounts payable, and deferred taxes.

Valuation Techniques

The following describes the valuation techniques used to measure the fair value of the assets and liabilities

shown in the table above. All investments that are valued using a net asset value per share can be redeemed

quarterly with a notice not to exceed 90 days.

90