PG&E 2013 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2013 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

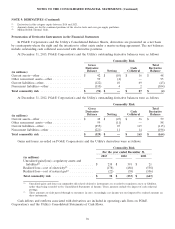

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (Continued)

NOTE 5: COMMON STOCK AND SHARE-BASED COMPENSATION (Continued)

ability to issue an additional $5 million of its common stock under this agreement. During 2013, PG&E Corporation

paid commissions of $3 million under this agreement.

During 2013, PG&E Corporation issued 26 million shares of its common stock for aggregate net cash proceeds

of $1,045 million in the following transactions:

• 7 million shares were sold in an underwritten public offering for cash proceeds of $300 million, net of fees

and commissions;

• 8 million shares were issued for cash proceeds of $290 million under the PG&E Corporation 401(k) plan, the

Dividend Reinvestment and Stock Purchase Plan, and share-based compensation plans; and

• 11 million shares were sold for cash proceeds of $455 million, net of commissions paid of $4 million, under

equity distribution agreements.

Dividends

The Board of Directors of PG&E Corporation and the Utility declare dividends quarterly. Under the Utility’s

Articles of Incorporation, the Utility cannot pay common stock dividends unless all cumulative preferred dividends

on the Utility’s preferred stock have been paid. For 2013, the Board of Directors of PG&E Corporation declared a

quarterly common stock dividend of $0.455 per share.

Under their respective credit agreements, PG&E Corporation and the Utility are each required to maintain a

ratio of consolidated total debt to consolidated capitalization of at most 65%. Based on the calculation of this ratio,

$493 million of the Utility’s reinvested earnings was restricted at December 31, 2013. In addition, the CPUC requires

the Utility to maintain a capital structure composed of at least 52% equity on average. At December 31, 2013, the

Utility was required to maintain reinvested earnings of $7.4 billion as equity to meet this requirement.

In addition, to comply with the revolving credit facility’s 65% ratio requirement and the CPUC’s requirement to

maintain a 52% equity component, $7.7 billion and $14.6 billion of the Utility’s net assets were restricted at

December 31, 2013 to comply with these requirements, respectively, and could not be transferred to PG&E

Corporation in the form of cash dividends. As a holding company, PG&E Corporation depends on cash distributions

from the Utility to meet its debt service and other financial obligations and to pay dividends on its common stock.

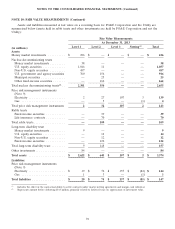

Long-Term Incentive Plan

The PG&E Corporation LTIP permits various forms of share-based incentive awards, including stock options,

stock appreciation rights, restricted stock awards, RSUs, performance shares, deferred compensation awards, and

other share-based awards, to eligible employees of PG&E Corporation and its subsidiaries. Non-employee directors

of PG&E Corporation are also eligible to receive certain share-based awards. A maximum of 12 million shares of

PG&E Corporation common stock (subject to adjustment for changes in capital structure, stock dividends, or other

similar events) has been reserved for issuance under the 2006 LTIP, of which 3,310,474 shares were available for

future awards at December 31, 2013.

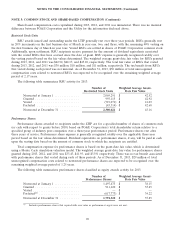

The following table provides a summary of total share-based compensation expense recognized by PG&E

Corporation for share-based incentive awards for 2013, 2012, and 2011:

2013 2012 2011

(in millions)

Restricted stock units ....................... $ 36 $ 31 $ 23

Performance shares:

Equity awards ............................. 28 26 16

Liability awards ............................ — — (13)

Total compensation expense (pre-tax) ............ $64$57$26

Total compensation expense (after-tax) ........... $38$34$16

68