PG&E 2013 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2013 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

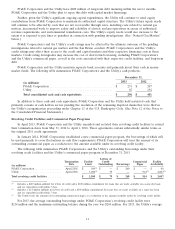

outstanding commercial paper balance was $542 million and the maximum outstanding balance during the year was

$1.1 billion. The Utility did not borrow under its credit facility in 2013.

The revolving credit facilities include usual and customary provisions for revolving credit facilities of this type,

including those regarding events of default and covenants limiting liens to those permitted under PG&E

Corporation’s and the Utility’s senior note indentures, mergers, sales of all or substantially all of PG&E

Corporation’s and the Utility’s assets, and other fundamental changes. In addition, the revolving credit facilities

require that PG&E Corporation and the Utility maintain a ratio of total consolidated debt to total consolidated

capitalization of at most 65% as of the end of each fiscal quarter. PG&E Corporation’s revolving credit facility

agreement also requires that PG&E Corporation own, directly or indirectly, at least 80% of the common stock and

at least 70% of the voting capital stock of the Utility. At December 31, 2013, PG&E Corporation and the Utility

were in compliance with all covenants under their respective revolving credit facilities.

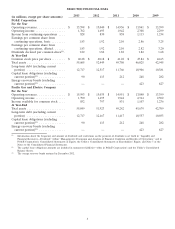

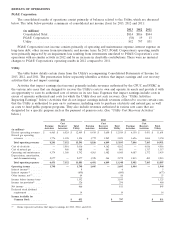

2013 Financings

Utility

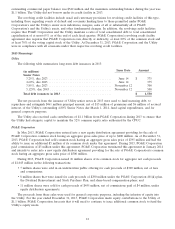

The following table summarizes long-term debt issuances in 2013:

Issue Date Amount

(in millions)

Senior Notes

3.25%, due 2023 .................................... June 14 $ 375

4.60%, due 2043 .................................... June 14 375

3.85%, due 2023 .................................... November 12 300

5.125%, due 2043 ................................... November 12 500

Total debt issuances in 2013 ............................. $ 1,550

The net proceeds from the issuance of Utility senior notes in 2013 were used to fund maturing debt, to

repurchase and extinguish $461 million principal amount, net of $15 million of premiums and $6 million of accrued

interest, of the Utility’s outstanding 4.80% Senior Notes due March 1, 2014, fund capital expenditures, and for

general corporate purposes.

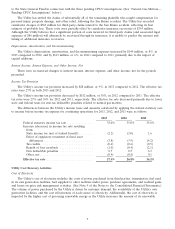

The Utility also received cash contributions of $1.1 billion from PG&E Corporation during 2013 to ensure that

the Utility had adequate capital to maintain the 52% common equity ratio authorized by the CPUC.

PG&E Corporation

In May 2013, PG&E Corporation entered into a new equity distribution agreement providing for the sale of

PG&E Corporation common stock having an aggregate gross sales price of up to $400 million. As of December 31,

2013, PG&E Corporation had sold common stock having an aggregate gross sales price of $395 million and had the

ability to issue an additional $5 million of its common stock under this agreement. During 2013, PG&E Corporation

paid commissions of $3 million under this agreement. PG&E Corporation terminated this agreement in January 2014

and intends to enter into a new equity distribution agreement providing for the sale of PG&E Corporation’s common

stock having an aggregate gross sales price of $500 million.

During 2013, PG&E Corporation issued 26 million shares of its common stock for aggregate net cash proceeds

of $1,045 million in the following transactions:

• 7 million shares were sold in an underwritten public offering for cash proceeds of $300 million, net of fees

and commissions;

• 8 million shares that were issued for cash proceeds of $290 million under the PG&E Corporation 401(k) plan,

the Dividend Reinvestment and Stock Purchase Plan, and share-based compensation plans; and

• 11 million shares were sold for cash proceeds of $455 million, net of commissions paid of $4 million, under

equity distribution agreements.

The proceeds from these sales were used for general corporate purposes, including the infusion of equity into

the Utility. For the year ended December 31, 2013, PG&E Corporation made equity contributions to the Utility of

$1.1 billion. PG&E Corporation forecasts that it will need to continue to issue additional common stock to fund the

Utility’s equity needs.

12