PG&E 2013 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2013 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Other Pending Lawsuits and Claims

At December 31, 2013, there were also four purported shareholder derivative lawsuits outstanding against

PG&E Corporation and the Utility seeking recovery on behalf of PG&E Corporation and the Utility for alleged

breaches of fiduciary duty by officers and directors, among other claims. The plaintiffs for three of these lawsuits

have filed a consolidated complaint with the San Mateo County Superior Court. The court has lifted the stay on

these proceedings for the limited purpose of allowing the parties to exchange information and discuss possible

resolution. A case management conference is scheduled for April 18, 2014. The remaining purported shareholder

derivative lawsuit, filed in the U.S. District Court for the Northern District of California, remains stayed.

In February 2011, the Board of Directors of PG&E Corporation authorized PG&E Corporation to reject a

demand made by another shareholder that the Board of Directors (1) institute an independent investigation of the

San Bruno accident and related alleged safety issues; (2) seek recovery of all costs associated with such issues

through legal proceedings against those determined to be responsible, including Board of Directors members,

officers, other employees, and third parties; and (3) adopt corporate governance initiatives and safety programs. The

Board of Directors also reserved the right to commence further investigation or litigation regarding the San Bruno

accident if the Board of Directors deems such investigation or litigation appropriate.

PG&E Corporation and the Utility are uncertain when and how the above lawsuits will be resolved.

REGULATORY MATTERS

The Utility is subject to substantial regulation by the CPUC, the FERC, the NRC and other federal and state

regulatory agencies. The resolutions of these and other proceedings may affect PG&E Corporation’s and the Utility’s

financial condition, results of operations, and cash flows.

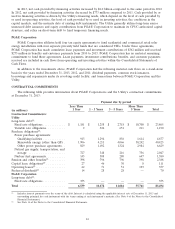

2014 General Rate Case

On November 15, 2012, the Utility filed its 2014 GRC application with the CPUC. In the Utility’s GRC, the

CPUC will determine the revenue requirements that the Utility is authorized to collect through rates from 2014

through 2016 to recover anticipated costs associated with electric generation operations and electric and natural gas

distribution operations. The Utility has requested that the CPUC authorize a total revenue requirement of

$7.8 billion for 2014, representing an increase of approximately $1.16 billion over the comparable authorized

revenues for 2013. The Utility also has requested that the CPUC authorize attrition increases in 2015 and 2016 of

$436 million and $486 million, respectively. The requested increase is intended to allow the Utility to recover the

costs it forecasts it will incur to continue making improvements to the safety and reliability of its operations.

The CPUC’s ORA recommended that the Utility’s 2014 revenue requirements be reduced by $125 million from

amounts authorized in 2013, approximately $1.29 billion lower than the Utility’s current forecast. The ORA also has

recommended attrition increases of $169 million for 2015 and $160 million for 2016. The ORA’s recommendations

reflected reductions across all operations represented in the GRC. Twelve other parties, including TURN, also

submitted recommendations in the 2014 GRC.

A proposed decision is anticipated in the first quarter of 2014. Although it is uncertain when the CPUC will

issue a final decision, any approved revenue requirement changes will be effective as of January 1, 2014.

2015 Gas Transmission and Storage Rate Case

On December 19, 2013, the Utility filed its 2015 GT&S rate case application (covering 2015 through 2017)

requesting the CPUC approve a total annual revenue requirement of $1.29 billion for anticipated costs of providing

natural gas transmission and storage services beginning on January 1, 2015. This is an increase of $555 million over

the Utility’s authorized revenue requirements of $731 million for 2014, which includes revenue requirements

approved by the CPUC for both GT&S and PSEP. The Utility’s forecasts for the 2015 GT&S rate case period are

consistent with state law, which requires gas corporations to develop a plan to identify and minimize hazards and

systemic risk for public and employee safety. The forecasts include the continuation of work begun in the Utility’s

PSEP, such as testing pipelines to verify safe operating pressures, replacing older pipelines, installing more valves,

and inspecting the interior of more pipelines.

The Utility requested that the CPUC authorize the Utility’s forecast of its 2015 weighted average rate base for

its gas transmission and storage business of $3.56 billion, which includes the capital spend above authorized levels for

the prior rate case period. The Utility also requested additional revenue requirement increases of $61 million in 2016

20