PG&E 2013 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2013 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (Continued)

NOTE 4: DEBT (Continued)

(3) The Utility has obtained credit support from an insurance company for these bonds.

(4) At December 31, 2013, interest rates on these bonds and the related loans ranged from 0.01% to 0.02%.

(5) Each series of these bonds is supported by a separate direct-pay letter of credit. Series A and B letters of credit expire on

May 31, 2016. In October 2013, Series C and D letters of credit were extended to December 3, 2016 to coincide with the

maturity of the underlying bonds. Subject to certain requirements, the Utility may choose not to provide a credit facility without

issuer consent.

Pollution Control Bonds

The California Pollution Control Financing Authority and the California Infrastructure and Economic

Development Bank have issued various series of fixed rate and multi-modal tax-exempt pollution control bonds for

the benefit of the Utility. Substantially all of the net proceeds of the pollution control bonds were used to finance or

refinance pollution control and sewage and solid waste disposal facilities at the Geysers geothermal power plant or at

the Utility’s Diablo Canyon nuclear power plant. In 1999, the Utility sold all bond-financed facilities at the

non-retired units of the Geysers geothermal power plant to Geysers Power Company, LLC pursuant to purchase and

sale agreements stating that Geysers Power Company, LLC will use the bond-financed facilities solely as pollution

control facilities for so long as any tax-exempt pollution control bonds issued to finance the Geysers project are

outstanding. The Utility has no knowledge that Geysers Power Company, LLC intends to cease using the

bond-financed facilities solely as pollution control facilities.

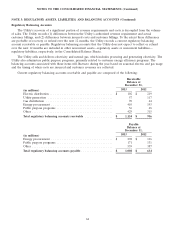

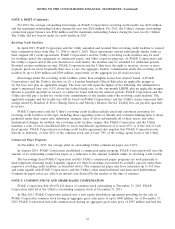

Repayment Schedule

PG&E Corporation’s and the Utility’s combined short-term and long-term debt principal repayment amounts at

December 31, 2013 are reflected in the table below:

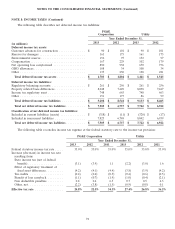

(in millions, except interest 2014 2015 2016 2017 2018 Thereafter Total

rates)

PG&E Corporation

Average fixed interest rate .... 5.75% —————5.75%

Fixed rate obligations ....... $ 350 $ — $ — $ — $ — $ — $ 350

Utility

Average fixed interest rate .... 4.80% — — 5.63% 8.25% 5.06% 5.29%

Fixed rate obligations ....... $ 539 $ — $ — $ 700 $ 800 $ 10,345 $ 12,384

Variable interest rate as of

December 31, 2013 ........ — — 0.02% — 0.02% — 0.02%

Variable rate obligations(1) .... $ — $ — $ 309 $ — $ 614 $ — $ 923

Total consolidated debt ..... $ 889 $ — $ 309 $ 700 $ 1,414 $ 10,345 $ 13,657

(1) These bonds, due in 2016 and 2026, are backed by separate letters of credit that expire on May 31, 2016, December 3, 2016, or April 1,

2018.

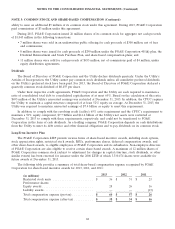

Short-term Borrowings

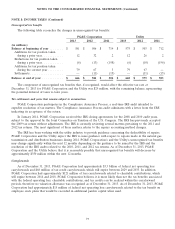

The following table summarizes PG&E Corporation’s and the Utility’s outstanding borrowings under their

revolving credit facilities and the Utility’s commercial paper program at December 31, 2013:

Letters of

Termination Facility Credit Commercial Facility

Date Limit Outstanding Borrowings Paper Availability

(in millions)

PG&E Corporation ........ April 2018 $ 300(1) $—$260$—$40

Utility .................. April 2018 3,000(2) 79 — 914(3) 2,007(3)

Total revolving credit facilities $ 3,300 $ 79 $ 260 $ 914 $ 2,047

(1) Includes a $100 million sublimit for letters of credit and a $100 million commitment for loans that are made available on a same-day basis

and are repayable in full within 7 days.

(2) Includes a $1.0 billion sublimit for letters of credit and a $300 million commitment for loans that are made available on a same-day basis

and are repayable in full within 7 days.

(3) The Utility treats the amount of its outstanding commercial paper as a reduction to the amount available under its revolving credit facility.

66