PG&E 2013 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2013 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

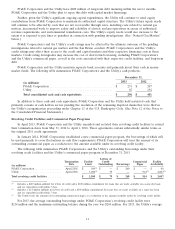

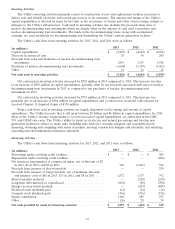

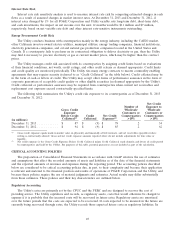

(3) See Note 11 of the Notes to the Consolidated Financial Statements. Payments into the pension and other benefits plans are based on annual

contribution requirements. As these annual requirements continue indefinitely into the future, the amount shown in the column entitled

‘‘more than 5 years’’ represents only 1 year of contributions for the Utility’s pension and other benefit plans.

(4) Based on historical performance, it is assumed for purposes of the table above that dividends are payable within a fixed period of five years.

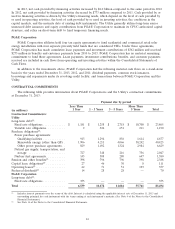

The contractual commitments table above excludes potential payments associated with unrecognized tax

positions. Due to the uncertainty surrounding tax audits, PG&E Corporation and the Utility cannot make reliable

estimates of the amounts and periods of future payments to major tax jurisdictions related to unrecognized tax

benefits. Matters relating to tax years that remain subject to examination are discussed in Note 8 of the Notes to the

Consolidated Financial Statements.

NATURAL GAS MATTERS

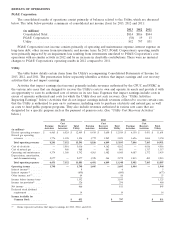

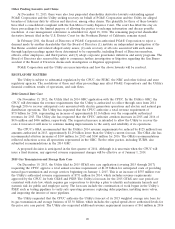

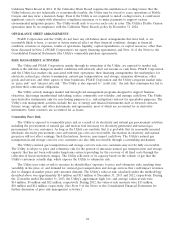

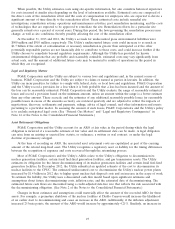

Since the San Bruno accident, PG&E Corporation and the Utility have incurred total cumulative charges of

approximately $2.5 billion related to natural gas matters that are not recoverable through rates, as shown in the

following table:

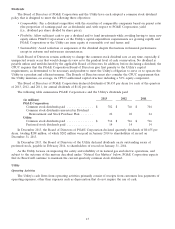

2013 2012 2011 2010 Total

(in millions)

Pipeline-related expenses(1) .......... $ 387 $ 477 $ 483 $ 63 $ 1,410

Disallowed capital(2) ............... 196 353 — — 549

Accrued fines(3) ................... 22 17 200 — 239

Third-party liability claims(4) ......... 110 80 155 220 565

Insurance recoveries(4) .............. (70) (185) (99) — (354)

Contribution(5) ................... — 70——70

Total natural gas matters ........... $ 645 $ 812 $ 739 $ 283 $ 2,479

(1) Cumulative expenses through December 31, 2013 include PSEP-related expenses of $736 million and other gas safety-related work of

$348 million.

(2) See ‘‘Disallowed Capital Costs’’ below.

(3) See ‘‘Pending CPUC Investigations’’ and ‘‘Other Enforcement Matters’’ below.

(4) The Utility has settled substantially all of the third-party liability claims related to the San Bruno accident. See ‘‘Operating and

Maintenance’’ above and ‘‘Note 14 of the Consolidated Financial Statements’’ below.

(5) On March 12, 2012, the Utility and the City of San Bruno entered into an agreement under which the Utility contributed $70 million to

support the city and the community’s recovery efforts.

Pending CPUC Investigations

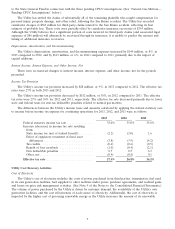

There are three CPUC investigative enforcement proceedings pending against the Utility that relate to (1) the

Utility’s safety recordkeeping for its natural gas transmission system, (2) the Utility’s operation of its natural gas

transmission pipeline system in or near locations of higher population density, and (3) the Utility’s pipeline

installation, integrity management, recordkeeping and other operational practices, and other events or courses of

conduct, that could have led to or contributed to the San Bruno accident.

The SED has issued investigative reports and briefs in each of these investigations alleging that the Utility

committed numerous violations of applicable laws and regulations. In July 2013, the SED recommended that the

CPUC impose what the SED characterizes as a penalty of $2.25 billion on the Utility, allocated as follows:

(1) $300 million as a fine to the State General Fund, (2) $435 million for a portion of costs related to the Utility’s

PSEP that were previously disallowed by the CPUC and funded by shareholders, and (3) $1.515 billion to perform

PSEP work that was previously approved by the CPUC, implement operational remedies, and for future costs. (See

‘‘Disallowed Capital Costs’’ below.) If the SED’s penalty recommendation is adopted, the Utility estimates that its

total unrecovered costs and fines related to natural gas transmission operations would be about $4.5 billion. Other

parties, including the City of San Bruno, TURN, the CPUC’s ORA, and the City and County of San Francisco, have

recommended total penalties of at least $2.25 billion, including fines payable to the State General Fund of differing

amounts.

17