PG&E 2013 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2013 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PG&E Corporation and the Utility have $889 million of long-term debt maturing within the next 6 months.

PG&E Corporation and the Utility plan to repay this debt with capital market financings.

Further, given the Utility’s significant ongoing capital expenditures, the Utility will continue to need equity

contributions from PG&E Corporation to maintain its authorized capital structure. The Utility’s future equity needs

will continue to be affected by costs that are not recoverable through rates, including costs related to natural gas

matters, incremental work to improve safety and reliability of electric and gas operations in excess of authorized

revenue requirements, and environmental remediation costs. The Utility’s equity needs would also increase to the

extent it is required to pay fines or penalties in connection with pending investigations. (See ‘‘Natural Gas Matters’’

below.)

PG&E Corporation’s and the Utility’s credit ratings may be affected by the ultimate outcome of the pending

investigations related to natural gas matters and the San Bruno accident. PG&E Corporation’s and the Utility’s

credit ratings may affect their access to the credit and capital markets and their respective financing costs in those

markets. Credit rating downgrades may increase the cost of short-term borrowing, including PG&E Corporation’s

and the Utility’s commercial paper, as well as the costs associated with their respective credit facilities, and long-term

debt.

PG&E Corporation and the Utility maintain separate bank accounts and primarily invest their cash in money

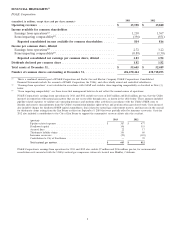

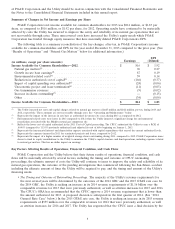

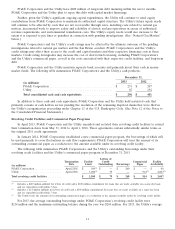

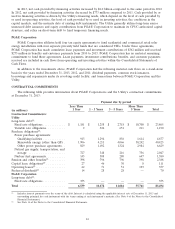

market funds. The following table summarizes PG&E Corporation’s and the Utility’s cash positions:

December 31,

2013 2012

(in millions)

PG&E Corporation .................................... $ 231 $ 207

Utility .............................................. 65 194

Total consolidated cash and cash equivalents ................. $ 296 $ 401

In addition to these cash and cash equivalents, PG&E Corporation and the Utility hold restricted cash that

primarily consists of cash held in escrow pending the resolution of the remaining disputed claims that were filed in

the Utility’s reorganization proceeding under Chapter 11 of the U.S. Bankruptcy Code. (See Note 12 of the Notes to

the Consolidated Financial Statements.)

Revolving Credit Facilities and Commercial Paper Programs

In April 2013, PG&E Corporation and the Utility amended and restated their revolving credit facilities to extend

their termination dates from May 31, 2016 to April 1, 2018. These agreements contain substantially similar terms as

the original 2011 credit agreements.

In January 2014, PG&E Corporation established a new commercial paper program, the borrowings of which will

be used primarily to cover fluctuations in cash flow requirements. PG&E Corporation will treat the amount of its

outstanding commercial paper as a reduction to the amount available under its revolving credit facility.

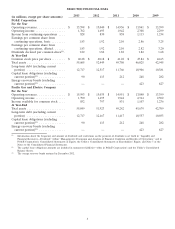

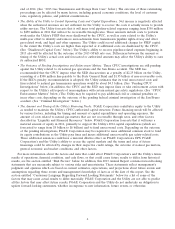

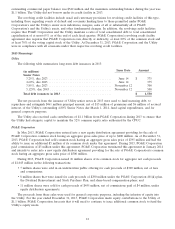

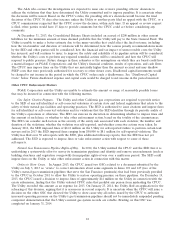

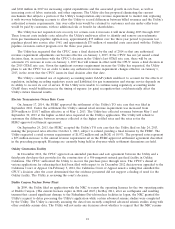

The following table summarizes PG&E Corporation’s and the Utility’s outstanding borrowings under their

revolving credit facilities and the Utility’s commercial paper program at December 31, 2013:

Letters of

Termination Facility Credit Commercial Facility

Date Limit Outstanding Borrowings Paper Availability

(in millions)

PG&E Corporation ................ April 2018 $ 300(1) $—$260$—$40

Utility ......................... April 2018 3,000(2) 79 — 914(3) 2,007(3)

Total revolving credit facilities ........ $ 3,300 $ 79 $ 260 $ 914 $ 2,047

(1) Includes a $100 million sublimit for letters of credit and a $100 million commitment for loans that are made available on a same-day basis

and are repayable in full within 7 days.

(2) Includes a $1.0 billion sublimit for letters of credit and a $300 million commitment for loans that are made available on a same-day basis

and are repayable in full within 7 days.

(3) The Utility treats the amount of its outstanding commercial paper as a reduction to the amount available under its revolving credit facility.

For 2013, the average outstanding borrowings under PG&E Corporation’s revolving credit facility were

$214 million and the maximum outstanding balance during the year was $260 million. For 2013, the Utility’s average

11