PG&E 2013 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2013 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

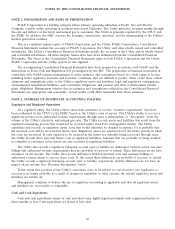

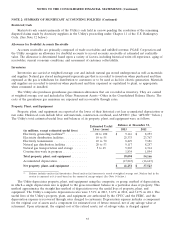

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (Continued)

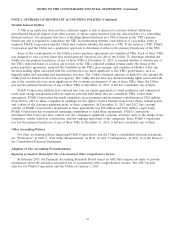

NOTE 2: SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

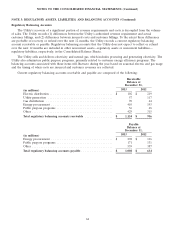

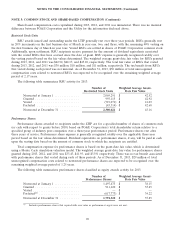

The changes, net of income tax, in PG&E Corporation’s accumulated other comprehensive income for the year

ended December 31, 2013 consisted of the following:

Pension Other Other

Benefits Benefits Investments Total

(in millions)

Beginning balance ............................ $ (28) $ (77) $ 4 $ (101)

Other comprehensive income before reclassifications:

Unrecognized net actuarial loss (net of taxes of $804,

$35, and $0, respectively) ................... 1,169 45 — 1,214

Transfer to regulatory account (net of taxes of $790,

$22, and $0, respectively) ................... (1,150) 31 — (1,119)

Gain on investments (net of taxes of $0, $0, and $26,

respectively) .............................——3838

Amounts reclassified from other comprehensive

income:(1)

Amortization of prior service cost (net of taxes of $8,

$10, and $0, respectively) ................... 12 13 — 25

Amortization of net actuarial loss (net of taxes of

$45, $3, and $0, respectively) ................. 66 3 — 69

Transfer to regulatory account (net of taxes of $54,

$0, and $0, respectively) .................... (76) — — (76)

Net current period other comprehensive income ...... 21 92 38 151

Ending balance .............................. $ (7) $ 15 $ 42 $ 50

(1) These components are included in the computation of net periodic pension and other postretirement benefit costs. (See Note 11 below for

additional details.)

With the exception of other investments, there was no material difference between PG&E Corporation and the

Utility for the information disclosed above.

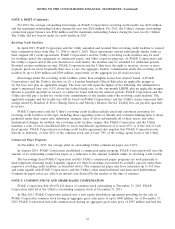

Disclosures about Offsetting Assets and Liabilities

In January 2013, the Financial Accounting Standards Board issued an ASU that clarifies the scope of disclosures

about offsetting assets and liabilities. The guidance requires an entity to disclose gross and net information about

derivatives that are offset in the balance sheet or subject to an enforceable master-netting arrangement or similar

agreement. The ASU became effective for PG&E Corporation and the Utility on January 1, 2013. (See Note 9

below.)

62