PG&E 2013 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2013 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Disallowed Capital Costs

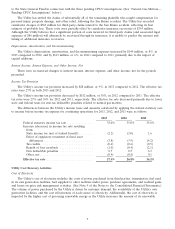

In 2011, the CPUC ordered all natural gas operators in California to submit proposed plans to modernize and

upgrade their natural gas transmission systems as well as associated cost forecasts and ratemaking proposals. In

December 2012, the CPUC approved most of the projects proposed in the Utility’s PSEP application that was filed

in August 2011, but disallowed the Utility’s request for rate recovery of a significant portion of costs the Utility

forecasted it would incur through 2014. In October 2013, the Utility updated its PSEP application to present the

results of its completed search and review of records relating to validation of operating pressure for all of the

approximately 6,750 miles of the Utility’s natural gas transmission pipelines. The Utility requested that the CPUC

approve changes to the scope and prioritization of PSEP work, including deferring some projects to after 2014 and

accelerating other projects, and that the CPUC adjust authorized revenue requirements to reflect these changes. The

Utility has requested that the CPUC issue a final decision by August 2014.

As of December 31, 2013, the Utility has recorded cumulative charges of $549 million for PSEP capital costs

that are expected to exceed the amount to be recovered. The Utility has requested that the CPUC authorize capital

costs of $766 million under the PSEP, reflecting the proposed changes in the PSEP update application. Of this

amount, approximately $280 million is recorded in Property, Plant, and Equipment on the Consolidated Balance

Sheets at December 31, 2013. The Utility could record additional charges to the extent PSEP capital costs are higher

than currently expected, or if additional capital costs are disallowed by the CPUC. The Utility’s ability to recover

PSEP capital costs also could be affected by the final decisions to be issued in the CPUC’s pending investigations

discussed above.

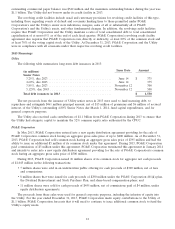

Criminal Investigation

In June 2011, the U.S. Department of Justice, the California Attorney General’s Office, and the San Mateo

County District Attorney’s Office began an investigation of the San Bruno accident and indicated that the Utility is a

target of the investigation. Although the San Mateo County District Attorney’s Office has publicly indicated that it

will not pursue state criminal charges, the U.S. Department of Justice may still bring criminal charges, including

charges based on claims that the Utility violated the federal Pipeline Safety Act, against PG&E Corporation or the

Utility. It is uncertain whether any criminal charges will be brought against any of PG&E Corporation’s or the

Utility’s current or former employees. The Utility is continuing to cooperate with federal investigators. A criminal

charge or finding would further harm the Utility’s reputation. PG&E Corporation and the Utility are unable to

estimate the amount or range of reasonably possible losses associated with any civil or criminal penalties that could

be imposed and such penalties could have a material impact on PG&E Corporation’s and the Utility’s financial

condition, results of operations, and cash flows. In addition, the Utility’s business or operations could be negatively

affected by any remedial measures that the Utility may undertake, such as operating its natural gas transmission

business subject to the supervision and oversight of an independent monitor.

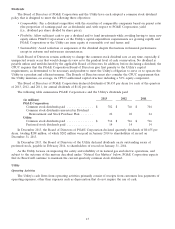

Third-party Liability Claims

See Note 14 of the Notes to the Consolidated Financial Statements.

Class Action Complaint

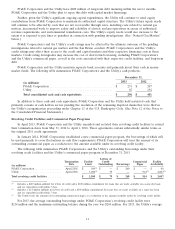

On August 23, 2012, a complaint was filed in the San Francisco Superior Court against PG&E Corporation and

the Utility (and other unnamed defendants) by individuals who seek certification of a class consisting of all California

residents who were customers of the Utility between 1997 and 2010, with certain exceptions. The plaintiffs allege that

the Utility collected more than $100 million in customer rates from 1997 through 2010 for the purpose of various

safety measures and operations projects but instead used the funds for general corporate purposes such as executive

compensation and bonuses. The plaintiffs allege that PG&E Corporation and the Utility engaged in unfair business

practices in violation of California state law. The plaintiffs seek restitution and disgorgement, as well as

compensatory and punitive damages.

PG&E Corporation and the Utility contest the plaintiffs’ allegations. On May 23, 2013, the court granted PG&E

Corporation’s and the Utility’s request to dismiss the complaint on the grounds that the CPUC has exclusive

jurisdiction to adjudicate the issues raised by the plaintiffs’ allegations. The plaintiffs have appealed the court’s ruling

to the California Court of Appeal. PG&E Corporation and the Utility are unable to estimate the amount or range of

reasonably possible losses, if any, that may be incurred in connection with this matter if the lower court’s ruling is

reversed.

19