PG&E 2013 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2013 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

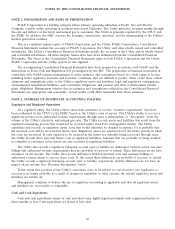

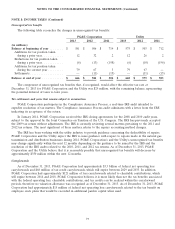

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (Continued)

NOTE 4: DEBT

Long-Term Debt

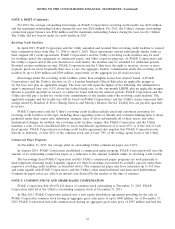

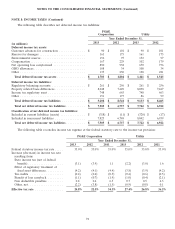

The following table summarizes PG&E Corporation’s and the Utility’s long-term debt:

December 31,

2013 2012

(in millions)

PG&E Corporation

Senior notes, 5.75%, due 2014 .......................... 350 350

Less: current portion ............................... (350) —

Total senior notes .................................. — 350

Total PG&E Corporation long-term debt ................... — 350

Utility

Senior notes:

6.25% due 2013 ................................... — 400

4.80% due 2014 ................................... 539 1,000

5.625% due 2017 .................................. 700 700

8.25% due 2018 ................................... 800 800

3.50% due 2020 ................................... 800 800

4.25% due 2021 ................................... 300 300

3.25% due 2021 ................................... 250 250

2.45% due 2022 ................................... 400 400

3.25% due 2023 ................................... 375 —

3.85% due 2023 ................................... 300 —

6.05% due 2034 ................................... 3,000 3,000

5.80% due 2037 ................................... 950 950

6.35% due 2038 ................................... 400 400

6.25% due 2039 ................................... 550 550

5.40% due 2040 ................................... 800 800

4.50% due 2041 ................................... 250 250

4.45% due 2042 ................................... 400 400

3.75% due 2042 ................................... 350 350

4.60% due 2043 ................................... 375 —

5.125% due 2043 .................................. 500 —

Less: current portion ............................... (539) (400)

Unamortized discount, net of premium .................. (51) (51)

Total senior notes, net of current portion ............... 11,449 10,899

Pollution control bonds:

Series 1996 C, E, F, 1997 B, variable rates(1), due 2026(2) ...... 614 614

Series 2004 A-D, 4.75%, due 2023(3) .................... 345 345

Series 2009 A-D, variable rates(4), due 2016 and 2026(5) ....... 309 309

Total pollution control bonds ........................ 1,268 1,268

Total Utility long-term debt, net of current portion ........... 12,717 12,167

Total consolidated long-term debt, net of current portion ......... $ 12,717 $ 12,517

(1) At December 31, 2013, interest rates on these bonds and the related loans ranged from 0.01% to 0.04%.

(2) Each series of these bonds is supported by a separate letter of credit. In April 2013, the letters of credit were extended to

April 1, 2018. Although the stated maturity date is 2026, each series will remain outstanding only if the Utility extends or

replaces the letter of credit related to the series or otherwise obtains consent from the issuer to the continuation of the series

without a credit facility.

65