PG&E 2013 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2013 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

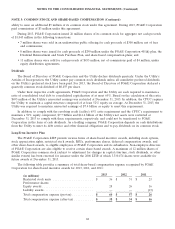

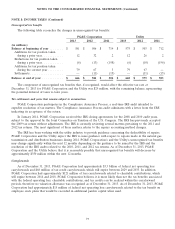

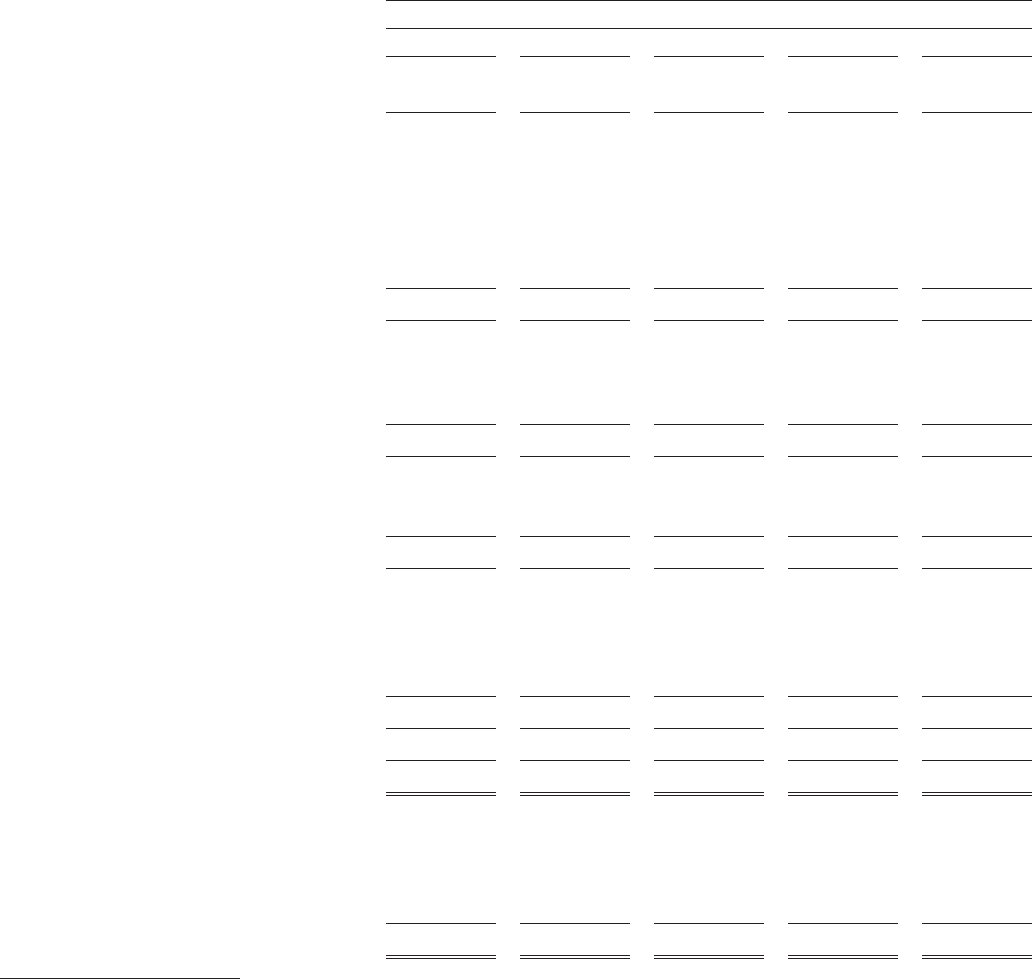

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (Continued)

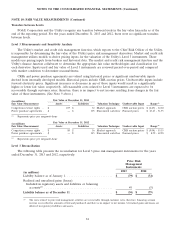

NOTE 10: FAIR VALUE MEASUREMENTS (Continued)

Assets and liabilities measured at fair value on a recurring basis for PG&E Corporation and the Utility are

summarized below (assets held in rabbi trusts and other investments are held by PG&E Corporation and not the

Utility):

Fair Value Measurements

At December 31, 2013

Level 1 Level 2 Level 3 Netting(1) Total

(in millions)

Assets:

Money market investments .......... $ 226 $ — $ — $ — $ 226

Nuclear decommissioning trusts

Money market investments ......... 38———38

U.S. equity securities ............. 1,046 11 — 1,057

Non-U.S. equity securities ......... 457 — — — 457

U.S. government and agency securities 760 156 — — 916

Municipal securities .............. — 25 — — 25

Other fixed-income securities ....... — 162 — — 162

Total nuclear decommissioning trusts(2) .. 2,301 354 — — 2,655

Price risk management instruments

(Note 9)

Electricity ..................... 2 27 107 3 139

Gas ......................... — 5 — (1) 4

Total price risk management instruments 2 32 107 2 143

Rabbi trusts

Fixed-income securities ........... — 39 — — 39

Life insurance contracts ........... — 70 — — 70

Total rabbi trusts .................. — 109 — — 109

Long-term disability trust

Money market investments ......... 9——— 9

U.S. equity securities ............. — 14 — — 14

Non-U.S. equity securities ......... — 12 — — 12

Fixed-income securities ........... — 122 — — 122

Total long-term disability trust ........ 9 148 — — 157

Other investments ................. 84———84

Total assets ..................... $ 2,622 $ 643 $ 107 $ 2 $ 3,374

Liabilities:

Price risk management instruments

(Note 9)

Electricity ..................... $ 19 $ 72 $ 137 $ (84) $ 144

Gas ......................... 1 3 — (1) 3

Total liabilities ................... $ 20 $ 75 $ 137 $ (85) $ 147

(1) Includes the effect of the contractual ability to settle contracts under master netting agreements and margin cash collateral.

(2) Represents amount before deducting $313 million, primarily related to deferred taxes on appreciation of investment value.

78