PG&E 2013 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2013 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (Continued)

NOTE 11: EMPLOYEE BENEFIT PLANS (Continued)

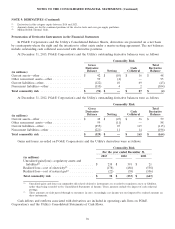

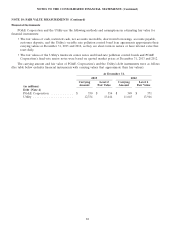

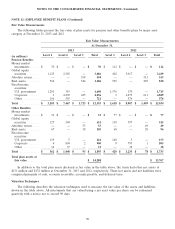

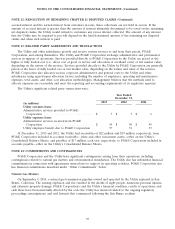

Other Benefits

2013 2012

(in millions)

Change in plan assets:

Fair value of plan assets at January 1 ...................... $ 1,758 $ 1,491

Actual return on plan assets .............................. 64 191

Company contributions ................................. 145 149

Plan participant contribution ............................. 64 55

Benefits and expenses paid .............................. (139) (128)

Fair value of plan assets at December 31 .................... $ 1,892 $ 1,758

Change in benefit obligation:

Benefit obligation at January 1 ........................... $ 1,940 $ 1,885

Service cost for benefits earned ........................... 53 49

Interest cost ......................................... 74 83

Actuarial gain ........................................ (415) (23)

Plan amendments ..................................... — 5

Benefits paid ......................................... (123) (119)

Federal subsidy on benefits paid ........................... 4 5

Plan participant contributions ............................. 64 55

Benefit obligation at December 31 ......................... $ 1,597 $ 1,940

Funded status(1):

Noncurrent asset ...................................... $ 352 $ —

Noncurrent liability .................................... (57) (181)

Accrued benefit cost at December 31 ....................... $ 295 $ (181)

(1) At December 31, 2013, the postretirement medical plan was in an overfunded position and the postretirement life insurance plan

was in an underfunded position. At December 31, 2012, both the postretirement medical plan and the postretirement life

insurance plan were in underfunded positions.

There was no material difference between PG&E Corporation and the Utility for the information disclosed

above.

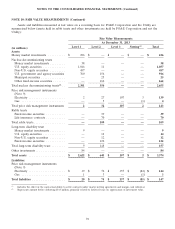

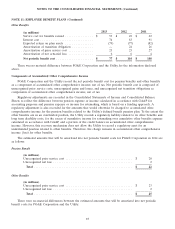

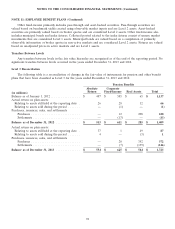

Components of Net Periodic Benefit Cost

Net periodic benefit cost as reflected in PG&E Corporation’s Consolidated Statements of Income was as

follows:

Pension Benefits

2013 2012 2011

(in millions)

Service cost for benefits earned ................ $ 468 $ 396 $ 320

Interest cost .............................. 627 658 660

Expected return on plan assets ................ (650) (598) (669)

Amortization of prior service cost .............. 20 20 34

Amortization of net actuarial loss .............. 111 123 50

Net periodic benefit cost ................... 576 599 395

Less: transfer to regulatory account(1) .......... (238) (301) (139)

Total ................................... $ 338 $ 298 $ 256

(1) The Utility recorded these amounts to a regulatory account as they are probable of recovery from customers in future rates.

86