PG&E 2013 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2013 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

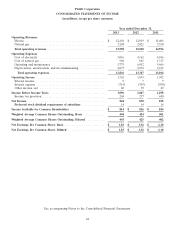

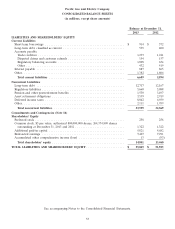

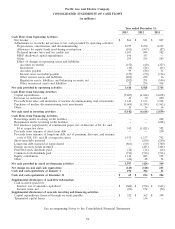

PG&E Corporation

CONSOLIDATED STATEMENTS OF EQUITY

(in millions, except share amounts)

Non

Accumulated controlling

Other Interest—

Common Common Comprehensive Total Preferred

Stock Stock Reinvested Income Shareholders’ Stock of Total

Shares Amount Earnings (Loss) Equity Subsidiary Equity

Balance at December 31,

2010 .............. 395,227,205 $ 6,878 $ 4,606 $ (202) $ 11,282 $ 252 $ 11,534

Net income ........... — — 858 — 858 — 858

Other comprehensive loss . .———(11)(11)—(11)

Common stock issued, net . 17,029,877 686 — — 686 — 686

Stock-based compensation

amortization ........ — 37——37—37

Common stock dividends

declared ........... — — (738) — (738) — (738)

Tax benefit from employee

stock plans ......... — 1 — — 1 — 1

Preferred stock dividend

requirement of subsidiary — — (14) — (14) — (14)

Balance at December 31,

2011 .............. 412,257,082 7,602 4,712 (213) 12,101 252 12,353

Net income ........... — — 830 — 830 — 830

Other comprehensive

income ............———112112—112

Common stock issued, net . 18,461,211 773 — — 773 — 773

Stock-based compensation

amortization ........ — 52——52—52

Common stock dividends

declared ........... — — (781) — (781) — (781)

Tax benefit from employee

stock plans ......... — 1 — — 1 — 1

Preferred stock dividend

requirement of subsidiary — — (14) — (14) — (14)

Balance at December 31,

2012 .............. 430,718,293 $ 8,428 $ 4,747 $ (101) $ 13,074 $ 252 $ 13,326

Net income ........... — — 828 — 828 — 828

Other comprehensive

income ............———151151—151

Common stock issued, net . 25,952,131 1,067 — — 1,067 — 1,067

Stock-based compensation

amortization ........ — 56——56—56

Common stock dividends

declared ........... — — (819) — (819) — (819)

Tax expense from employee

stock plans ......... — (1) — — (1) — (1)

Preferred stock dividend

requirement of subsidiary — — (14) — (14) — (14)

Balance at December 31,

2013 .............. 456,670,424 $ 9,550 $ 4,742 $ 50 $ 14,342 $ 252 $ 14,594

See accompanying Notes to the Consolidated Financial Statements.

49