PG&E 2013 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2013 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

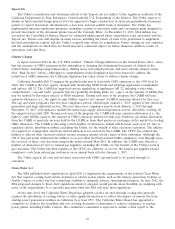

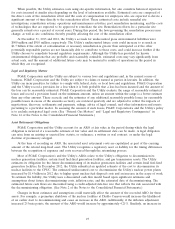

The following reflects the sensitivity of other postretirement benefit costs and accumulated benefit obligation to

changes in certain actuarial assumptions:

Increase Increase in 2013 Increase in Accumulated

(Decrease) in Other Postretirement Benefit Obligation at

Assumption Benefit Costs December 31, 2013

(in millions)

Health care cost trend rate . . 0.50% $ 7 $ 43

Discount rate .......... (0.50)% 7 104

Rate of return on plan assets . (0.50)% 9 —

CAUTIONARY LANGUAGE REGARDING FORWARD-LOOKING STATEMENTS

This 2013 Annual Report contains forward-looking statements that are necessarily subject to various risks and

uncertainties. These statements reflect management’s judgment and opinions which are based on current estimates,

expectations, and projections about future events and assumptions regarding these events and management’s

knowledge of facts as of the date of this report. These forward-looking statements relate to, among other matters,

estimated losses, including penalties and fines, associated with various investigations; forecasts of costs the Utility will

incur to make safety and reliability improvements, including natural gas transmission costs that the Utility will not

recover through rates; forecasts of capital expenditures; estimates and assumptions used in critical accounting

policies, including those relating to regulatory assets and liabilities, environmental remediation, litigation, third-party

claims, and other liabilities; and the level of future equity or debt issuances. These statements are also identified by

words such as ‘‘assume,’’ ‘‘expect,’’ ‘‘intend,’’ ‘‘forecast,’’ ‘‘plan,’’ ‘‘project,’’ ‘‘believe,’’ ‘‘estimate,’’ ‘‘predict,’’

‘‘anticipate,’’ ‘‘may,’’ ‘‘should,’’ ‘‘would,’’ ‘‘could,’’ ‘‘potential’’ and similar expressions. PG&E Corporation and the

Utility are not able to predict all the factors that may affect future results. Some of the factors that could cause

future results to differ materially from those expressed or implied by the forward-looking statements, or from

historical results, include, but are not limited to:

• when and how the pending CPUC investigations and enforcement matters related to the Utility’s natural gas

system operating practices and the San Bruno accident are concluded, including the ultimate amount of fines

the Utility will be required to pay to the State General Fund, the amount of natural gas transmission costs the

Utility will be prohibited from recovering, and the cost of any remedial actions the Utility may be ordered to

perform;

• the outcome of the pending federal criminal investigation related to the San Bruno accident, including the

ultimate amount of civil or criminal fines or penalties, if any, the Utility may be required to pay, and the

impact of remedial measures the Utility is required to take such as the appointment of an independent

monitor;

• whether PG&E Corporation and the Utility are able to repair the reputational harm that they have suffered,

and may suffer in the future, due to the negative publicity surrounding the San Bruno accident and the

decisions to be issued in the pending investigations, including any charge or finding of criminal liability;

• the outcomes of ratemaking proceedings, such as the 2014 GRC, the 2015 GT&S rate case, and the TO rate

cases;

• the amount and timing of additional common stock issuances by PG&E Corporation, the proceeds of which

are contributed as equity to maintain the Utility’s authorized capital structure as the Utility incurs charges and

costs that it cannot recover through rates, including costs and fines associated with natural gas matters and the

pending investigations;

• the outcome of future regulatory investigations, citations, or other proceedings, that may be commenced

relating to the Utility’s compliance with laws, rules, regulations, or orders applicable to the operation,

inspection, and maintenance of its electric and gas facilities;

• the impact of environmental remediation laws, regulations, and orders; the ultimate amount of costs incurred

to discharge the Utility’s known and unknown remediation obligations; the extent to which the Utility is able

to recover environmental compliance and remediation costs in rates or from other sources; and the ultimate

amount of environmental remediation costs the Utility incurs but does not recover, such as the remediation

costs associated with the Utility’s natural gas compressor station site located near Hinkley, California;

• the impact of new legislation or NRC regulations, recommendations, policies, decisions, or orders relating to

the nuclear industry, including operations, seismic design, security, safety, relicensing, the storage of spent

29