PG&E 2013 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2013 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (Continued)

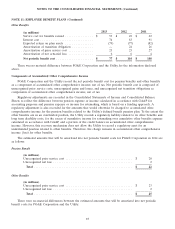

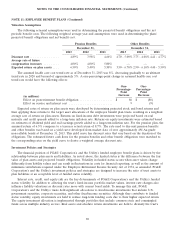

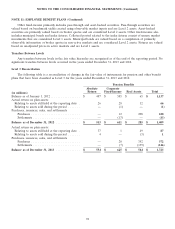

NOTE 11: EMPLOYEE BENEFIT PLANS (Continued)

holdings in equity and fixed-income investments by exhibiting returns with low correlation to the direction of these

markets. Real assets include commodities futures, REITS, global listed infrastructure equities, and private real estate

funds. Absolute return investments include hedge fund portfolios.

Target allocations for equity investments have generally declined in favor of longer-maturity fixed-income

investments and real assets as a means of dampening future funded status volatility. Derivative instruments such as

equity index futures contracts are used to maintain existing equity exposure while adding exposure to fixed-income

securities. In addition, derivative instruments such as equity index futures and fixed income futures are used to

rebalance the fixed income/equity allocation of the pension’s portfolio. Foreign currency exchange contracts are also

used to hedge a portion of the currency of the global equity investments.

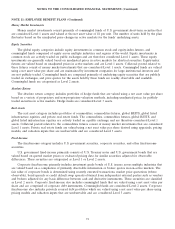

PG&E Corporation and the Utility apply a risk management framework for managing the risks associated with

employee benefit plan trust assets. The guiding principles of this risk management framework are the clear

articulation of roles and responsibilities, appropriate delegation of authority, and proper accountability and

documentation. Trust investment policies and investment manager guidelines include provisions designed to ensure

prudent diversification, manage risk through appropriate use of physical direct asset holdings and derivative

securities, and identify permitted and prohibited investments.

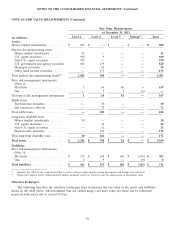

The target asset allocation percentages for major categories of trust assets for pension and other benefit plans

are as follows:

Pension Benefits Other Benefits

2014 2013 2012 2014 2013 2012

Global equity securities .......... 25% 25% 35% 30% 28% 38%

Absolute return ............... 5% 5% 5% 3% 4% 4%

Real assets ................... 10% 10% 10% 8% 8% 8%

Extended fixed-income securities . . . 3% 3% 3% —% —% —%

Fixed-income securities .......... 57% 57% 47% 59% 60% 50%

Total ....................... 100% 100% 100% 100% 100% 100%

89