PG&E 2013 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2013 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (Continued)

NOTE 12: RESOLUTION OF REMAINING CHAPTER 11 DISPUTED CLAIMS (Continued)

accrued interest and the earned interest from customers in rates, these collections are not held in escrow. If the

amount of accrued interest is greater than the amount of interest ultimately determined to be owed on the remaining

net disputed claims, the Utility would refund to customers any excess interest collected. The amount of any interest

that the Utility may be required to pay will depend on the final determined amount of the remaining net disputed

claims and when such interest is paid.

NOTE 13: RELATED PARTY AGREEMENTS AND TRANSACTIONS

The Utility and other subsidiaries provide and receive various services to and from their parent, PG&E

Corporation, and among themselves. The Utility and PG&E Corporation exchange administrative and professional

services in support of operations. Services provided directly to PG&E Corporation by the Utility are priced at the

higher of fully loaded cost (i.e., direct cost of good or service and allocation of overhead costs) or fair market value,

depending on the nature of the services. Services provided directly to the Utility by PG&E Corporation are generally

priced at the lower of fully loaded cost or fair market value, depending on the nature and value of the services.

PG&E Corporation also allocates various corporate administrative and general costs to the Utility and other

subsidiaries using agreed-upon allocation factors, including the number of employees, operating and maintenance

expenses, total assets, and other cost allocation methodologies. Management believes that the methods used to

allocate expenses are reasonable and meet the reporting and accounting requirements of its regulatory agencies.

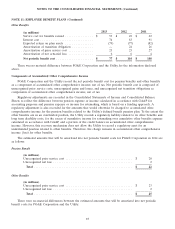

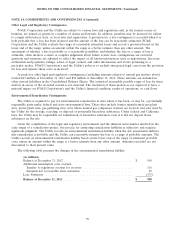

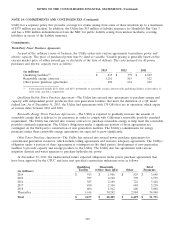

The Utility’s significant related party transactions were:

Year Ended

December 31,

2013 2012 2011

(in millions)

Utility revenues from:

Administrative services provided to PG&E

Corporation ............................ $ 7 $ 7 $ 6

Utility expenses from:

Administrative services received from PG&E

Corporation ............................ $ 45 $ 50 $ 49

Utility employee benefit due to PG&E Corporation . 57 51 33

At December 31, 2013 and 2012, the Utility had receivables of $22 million and $19 million, respectively, from

PG&E Corporation included in accounts receivable—other and other noncurrent assets—other on the Utility’s

Consolidated Balance Sheets, and payables of $17 million, each year respectively, to PG&E Corporation included in

accounts payable—other on the Utility’s Consolidated Balance Sheets.

NOTE 14: COMMITMENTS AND CONTINGENCIES

PG&E Corporation and the Utility have significant contingencies arising from their operations, including

contingencies related to natural gas matters and environmental remediation. The Utility also has substantial financial

commitments in connection with agreements entered into to support its operating activities. PG&E Corporation also

has financial commitments described under ‘‘Other Commitments’’ below.

Natural Gas Matters

On September 9, 2010, a natural gas transmission pipeline owned and operated by the Utility ruptured in San

Bruno, California. The ensuing explosion and fire resulted in the deaths of eight people, numerous personal injuries,

and extensive property damage. PG&E Corporation’s and the Utility’s financial condition, results of operations, and

cash flows have been materially affected by the costs the Utility has incurred related to the ongoing regulatory

proceedings, investigations, and civil lawsuits that commenced following the San Bruno accident.

95