PG&E 2013 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2013 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (Continued)

NOTE 8: INCOME TAXES (Continued)

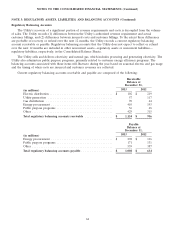

Unrecognized tax benefits

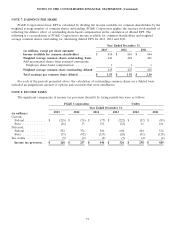

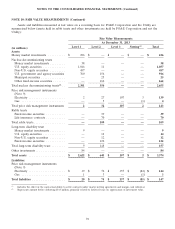

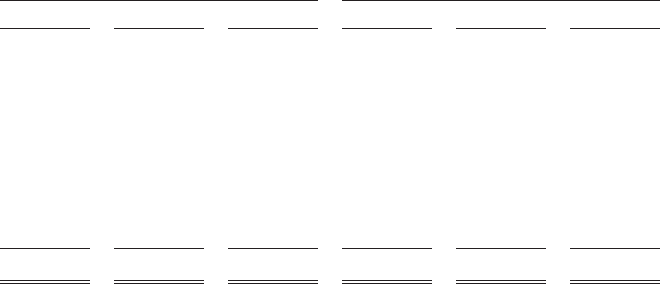

The following table reconciles the changes in unrecognized tax benefits:

PG&E Corporation Utility

2013 2012 2011 2013 2012 2011

(in millions)

Balance at beginning of year ........ $ 581 $ 506 $ 714 $ 575 $ 503 $ 712

Additions for tax position taken

during a prior year ............ 12 32 2 12 26 2

Reductions for tax position taken

during a prior year ............ (6) (13) (198) (6) (10) (196)

Additions for tax position taken

during the current year ......... 79 67 3 79 67 —

Settlements ................... — (11) (15) — (11) (15)

Balance at end of year ............ $ 666 $ 581 $ 506 $ 660 $ 575 $ 503

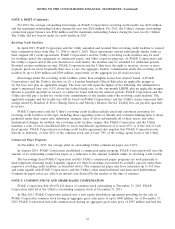

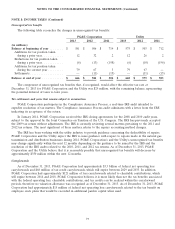

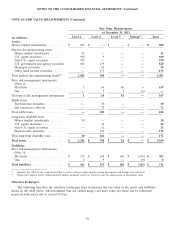

The component of unrecognized tax benefits that, if recognized, would affect the effective tax rate at

December 31, 2013 for PG&E Corporation and the Utility was $29 million, with the remaining balance representing

the potential deferral of taxes to later years.

Tax settlements and years that remain subject to examination

PG&E Corporation participates in the Compliance Assurance Process, a real-time IRS audit intended to

expedite resolution of tax matters. The Compliance Assurance Process audit culminates with a letter from the IRS

indicating its acceptance of the return.

In January 2014, PG&E Corporation received the IRS closing agreements for the 2008 and 2010 audit years,

subject to the approval by the Joint Committee on Taxation of the U.S. Congress. The IRS has previously accepted

the 2009 tax return without adjustments. The IRS is currently reviewing several matters pertaining to the 2011 and

2012 tax returns. The most significant of these matters relates to the repairs accounting method changes.

The IRS has been working with the utility industry to provide guidance concerning the deductibility of repairs.

PG&E Corporation and the Utility expect the IRS to issue guidance with respect to repairs made in the natural gas

transmission and distribution businesses during 2014. PG&E Corporation’s and the Utility’s unrecognized tax benefits

may change significantly within the next 12 months depending on the guidance to be issued by the IRS and the

resolution of the IRS audits related to the 2010, 2011, and 2012 tax returns. As of December 31, 2013, PG&E

Corporation and the Utility believe that it is reasonably possible that unrecognized tax benefits will decrease by

approximately $350 million within the next 12 months.

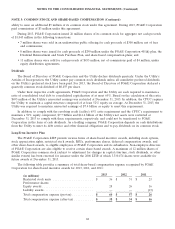

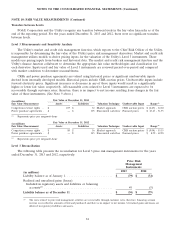

Carryforwards

As of December 31, 2013, PG&E Corporation had approximately $3.3 billion of federal net operating loss

carryforwards and $68 million of tax credit carryforwards, which will expire between 2029 and 2033. In addition,

PG&E Corporation had approximately $121 million of loss carryforwards related to charitable contributions, which

will expire between 2014 and 2018. PG&E Corporation believes it is more likely than not the tax benefits associated

with the federal operating loss, charitable contributions, and tax credits can be realized within the carryforward

periods, therefore no valuation allowance was recognized as of December 31, 2013. As of December 31, 2013, PG&E

Corporation had approximately $15 million of federal net operating loss carryforwards related to the tax benefit on

employee stock plans that would be recorded in additional paid-in capital when used.

73