PG&E 2013 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2013 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (Continued)

NOTE 8: INCOME TAXES (Continued)

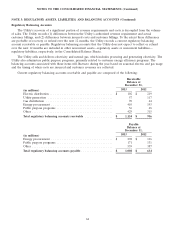

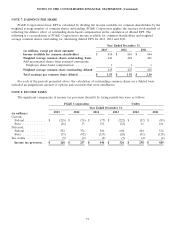

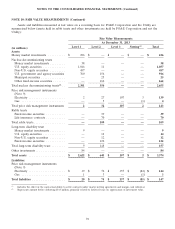

The following table describes net deferred income tax liabilities:

PG&E

Corporation Utility

Year Ended December 31,

2013 2012 2013 2012

(in millions)

Deferred income tax assets:

Customer advances for construction ............... $ 90 $ 101 $ 90 $ 101

Reserve for damages .......................... 161 175 161 175

Environmental reserve ......................... 152 97 152 97

Compensation ............................... 167 229 102 179

Net operating loss carryforward .................. 890 938 670 736

GHG allowances ............................. 108 34 108 34

Other ..................................... 135 230 128 221

Total deferred income tax assets ................ $ 1,703 $ 1,804 $ 1,411 $ 1,543

Deferred income tax liabilities:

Regulatory balancing accounts ................... $ 261 $ 256 $ 261 $ 256

Property related basis differences ................. 8,048 7,449 8,038 7,447

Income tax regulatory asset ..................... 748 663 748 663

Other ..................................... 151 173 86 99

Total deferred income tax liabilities ............. $ 9,208 $ 8,541 $ 9,133 $ 8,465

Total net deferred income tax liabilities ........... $ 7,505 $ 6,737 $ 7,722 $ 6,922

Classification of net deferred income tax liabilities:

Included in current liabilities (assets) .............. $ (318) $ (11) $ (320) $ (17)

Included in noncurrent liabilities ................. 7,823 6,748 8,042 6,939

Total net deferred income tax liabilities ........... $ 7,505 $ 6,737 $ 7,722 $ 6,922

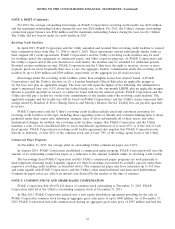

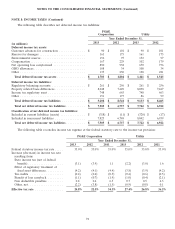

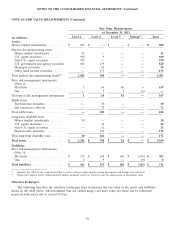

The following table reconciles income tax expense at the federal statutory rate to the income tax provision:

PG&E Corporation Utility

Year Ended December 31,

2013 2012 2011 2013 2012 2011

Federal statutory income tax rate ..... 35.0% 35.0% 35.0% 35.0% 35.0% 35.0%

Increase (decrease) in income tax rate

resulting from:

State income tax (net of federal

benefit) .................... (3.1) (3.9) 1.1 (2.2) (3.0) 1.6

Effect of regulatory treatment of

fixed asset differences .......... (4.2) (4.1) (4.4) (3.8) (3.9) (4.2)

Tax credits ................... (0.4) (0.6) (0.5) (0.4) (0.6) (0.5)

Benefit of loss carryback ......... (1.1) (0.7) (1.9) (1.0) (0.4) (2.1)

Non deductible penalties ......... 0.8 0.6 6.5 0.7 0.5 6.3

Other, net .................... (2.2) (3.8) (1.5) (0.9) (0.8) 0.1

Effective tax rate ................ 24.8% 22.5% 34.3% 27.4% 26.8% 36.2%

72