PG&E 2013 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2013 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

energy deliveries to comply with California legislative and regulatory requirements, and by costs associated with

complying with California’s GHG laws.

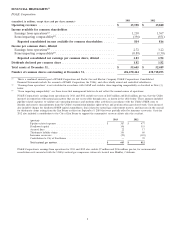

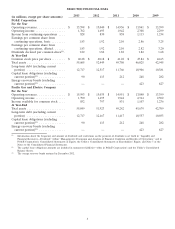

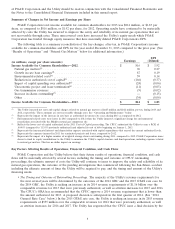

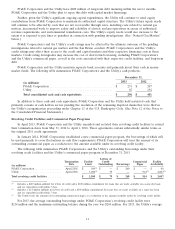

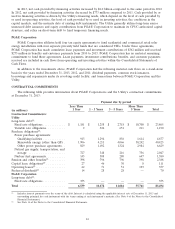

2013 2012 2011

(in millions)

Cost of purchased power ..................... $ 4,696 $ 3,873 $ 3,719

Fuel used in own generation facilities ............ 320 289 297

Total cost of electricity ...................... $ 5,016 $ 4,162 $ 4,016

Average cost of purchased power per kWh ........ $ 0.094 $ 0.079 $ 0.089

Total purchased power (in millions of kWh) ....... 49,941 48,933 41,958

Cost of Gas

The Utility’s cost of natural gas includes the costs of procurement, storage, transportation of natural gas and

realized gains and losses on price risk management activities. (See Note 9 of the Notes to the Consolidated Financial

Statements.) The Utility’s future cost of natural gas will be affected by the market price of natural gas, changes in

the cost of storage and transportation, changes in customer demand, and by costs associated with complying with

California’s GHG laws.

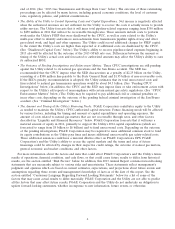

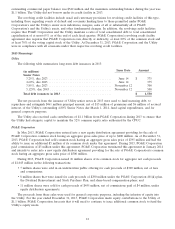

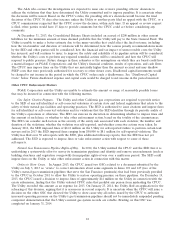

2013 2012 2011

(in millions)

Cost of natural gas sold ...................... $ 807 $ 676 $ 1,136

Transportation cost of natural gas sold ........... 161 185 181

Total cost of natural gas ..................... $ 968 $ 861 $ 1,317

Average cost per Mcf of natural gas sold ......... $ 3.54 $ 2.91 $ 4.49

Total natural gas sold (in millions of Mcf)(1) ....... 228 232 253

(1) One thousand cubic feet

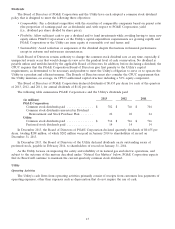

Operating Expenses

The Utility’s operating expenses also include certain recoverable costs that the Utility is required to incur as part

of its operations and include public purpose programs, pension, and other continuous business expenses.

Additionally, operating expenses in 2012 and 2011 include the amortization of energy recovery bonds regulatory asset

which fully amortized in 2012. If the Utility were to spend over authorized amounts, these expenses could have an

impact to earnings.

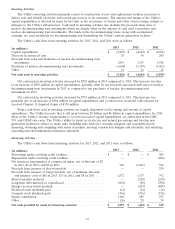

LIQUIDITY AND FINANCIAL RESOURCES

Overview

The Utility’s ability to fund operations and make distributions to PG&E Corporation depends on the levels of

its operating cash flows and access to the capital and credit markets. The levels of the Utility’s operating cash and

short-term debt fluctuate as a result of seasonal load, volatility in energy commodity costs, collateral requirements

related to price risk management activities, the timing and amount of tax payments or refunds, and the timing and

effect of regulatory decisions and long-term financings, among other factors. The Utility generally utilizes equity

contributions from PG&E Corporation and long-term senior unsecured debt issuances to maintain its

CPUC-authorized capital structure. The Utility relies on short-term debt, including commercial paper, to fund

temporary financing needs. The CPUC authorizes the aggregate amount of long-term debt and short-term debt that

the Utility may issue and authorizes the Utility to recover its related debt financing costs. The Utility has short-term

borrowing authority of $4.0 billion, including $500 million that is restricted to certain contingencies.

PG&E Corporation’s ability to fund operations, make scheduled principal and interest payments, fund Utility

equity contributions as needed for the Utility to maintain its CPUC-authorized capital structure, and pay dividends

primarily depends on PG&E Corporation’s access to the capital and credit markets and the level of cash distributions

received from the Utility. PG&E Corporation’s equity contributions to the Utility are funded primarily through

common stock issuances. PG&E Corporation’s stock issuances used to fund Utility equity needs attributable to

unrecoverable costs and penalties have had and will continue to have a dilutive effective on PG&E Corporation’s

EPS. PG&E Corporation also may use draws under its revolving credit facility or issuances under its commercial

paper program to occasionally fund equity contributions on an interim basis.

10