PG&E 2013 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2013 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (Continued)

NOTE 14: COMMITMENTS AND CONTINGENCIES (Continued)

Nuclear Fuel Agreements

The Utility has entered into several purchase agreements for nuclear fuel. These agreements have remaining

terms ranging from one to 12 years and are intended to ensure long-term nuclear fuel supply. The contracts for

uranium and for conversion and enrichment services provide for 100% coverage of reactor requirements through

2020, while contracts for fuel fabrication services provide for 100% coverage of reactor requirements through 2017.

The Utility relies on a number of international producers of nuclear fuel in order to diversify its sources and provide

security of supply. Pricing terms are also diversified, ranging from market-based prices to base prices that are

escalated using published indices.

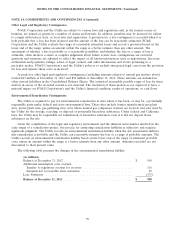

At December 31, 2013, the undiscounted future expected payment obligations for nuclear fuel were as follows:

(in millions)

2014 .......................................................... $ 145

2015 .......................................................... 162

2016 .......................................................... 146

2017 .......................................................... 148

2018 .......................................................... 132

Thereafter ...................................................... 647

Total .......................................................... $ 1,380

Payments for nuclear fuel amounted to $162 million in 2013, $118 million in 2012, and $77 million in 2011.

Other Commitments

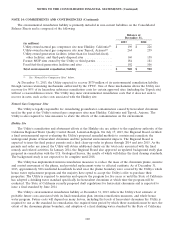

PG&E Corporation and the Utility have other commitments relating to operating leases. At December 31, 2013,

the future minimum payments related to these commitments were as follows:

(in millions)

2014 .......................................................... $ 42

2015 .......................................................... 37

2016 .......................................................... 34

2017 .......................................................... 27

2018 .......................................................... 24

Thereafter ...................................................... 193

Total .......................................................... $ 357

Payments for other commitments relating to operating leases amounted to $40 million in 2013, $32 million in

2012, and $27 million in 2011. PG&E Corporation and the Utility had operating leases on office facilities expiring at

various dates from 2014 to 2023. Certain leases on office facilities contain escalation clauses requiring annual

increases in rent ranging from 2% to 5%. The rentals payable under these leases may increase by a fixed amount

each year, a percentage of increase over base year, or the consumer price index. Most leases contain extension

options ranging between one and five years.

104