PG&E 2013 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2013 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

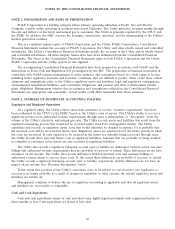

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (Continued)

NOTE 2: SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

Restricted Cash

Restricted cash consists primarily of the Utility’s cash held in escrow pending the resolution of the remaining

disputed claims made by electricity suppliers in the Utility’s proceeding under Chapter 11 of the U.S. Bankruptcy

Code. (See Note 12 below.)

Allowance for Doubtful Accounts Receivable

Accounts receivable are primarily composed of trade receivables and unbilled revenue. PG&E Corporation and

the Utility recognize an allowance for doubtful accounts to record accounts receivable at estimated net realizable

value. The allowance is determined based upon a variety of factors, including historical write-off experience, aging of

receivables, current economic conditions, and assessment of customer collectability.

Inventories

Inventories are carried at weighted-average cost and include natural gas stored underground as well as materials

and supplies. Natural gas stored underground represents gas that is recorded to inventory when purchased and then

expensed as the gas is withdrawn for distribution to customers or to be used as fuel for electric generation. Materials

and supplies are recorded to inventory when purchased and then expensed or capitalized to plant, as appropriate,

when consumed or installed.

The Utility also purchases greenhouse gas emission allowances that are recorded as inventory. They are carried

at weighted average cost and included in Other Noncurrent Assets—Other in the Consolidated Balance Sheets. The

costs of the greenhouse gas emissions are expensed and recoverable through rates.

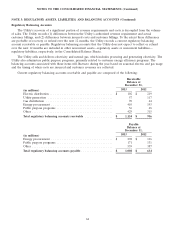

Property, Plant, and Equipment

Property, plant, and equipment are reported at the lower of their historical cost less accumulated depreciation or

fair value. Historical costs include labor and materials, construction overhead, and AFUDC. (See ‘‘AFUDC’’ below.)

The Utility’s total estimated useful lives and balances of its property, plant, and equipment were as follows:

Balance at December 31,

Estimated Useful

Lives (years) 2013 2012

(in millions, except estimated useful lives)

Electricity generating facilities(1) ............ 20 to 100 $ 9,116 $ 8,253

Electricity distribution facilities ............. 10 to 55 25,333 23,767

Electricity transmission ................... 10 to 70 8,429 7,681

Natural gas distribution facilities ............ 20 to 53 9,117 8,257

Natural gas transportation and storage ....... 5 to 65 5,265 4,314

Construction work in progress .............. 1,834 1,894

Total property, plant, and equipment ......... 59,094 54,166

Accumulated depreciation ................. (17,843) (16,643)

Net property, plant, and equipment .......... $ 41,251 $ 37,523

(1) Balance includes nuclear fuel inventories. Stored nuclear fuel inventory is stated at weighted average cost. Nuclear fuel in the

reactor is expensed as it is used based on the amount of energy output. (See Note 14 below.)

The Utility depreciates property, plant, and equipment using the composite, or group, method of depreciation,

in which a single depreciation rate is applied to the gross investment balance in a particular class of property. This

method approximates the straight line method of depreciation over the useful lives of property, plant, and

equipment. The Utility’s composite depreciation rates were 3.51% in 2013, 3.63% in 2012, and 3.67% in 2011. The

useful lives of the Utility’s property, plant, and equipment are authorized by the CPUC and the FERC, and the

depreciation expense is recovered through rates charged to customers. Depreciation expense includes a component

for the original cost of assets and a component for estimated cost of future removal, net of any salvage value at

retirement. Upon retirement, the original cost of the retired assets, net of salvage value, is charged against

57