PG&E 2013 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2013 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (Continued)

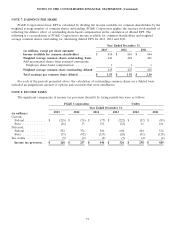

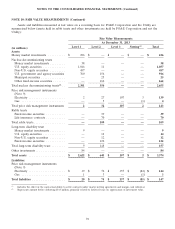

NOTE 10: FAIR VALUE MEASUREMENTS (Continued)

Money Market Investments

PG&E Corporation and the Utility invest in money market funds that seek to maintain a stable net asset value.

These funds invest in high quality, short-term, diversified money market instruments, such as U.S. Treasury bills, U.S.

agency securities, certificates of deposit, and commercial paper with a maximum weighted average maturity of

60 days or less. PG&E Corporation’s and the Utility’s investments in these money market funds are valued using

unadjusted prices for identical assets in an active market and are thus classified as Level 1. Money market funds are

recorded as cash and cash equivalents in the Consolidated Balance Sheets.

Trust Assets

The assets held by the nuclear decommissioning trusts, the rabbi trusts related to the non-qualified deferred

compensation plans, and the long-term disability trust are composed primarily of equity securities, debt securities,

and life insurance policies. In general, investments held in the trusts are exposed to various risks, such as interest

rate, credit, and market volatility risks.

Equity securities primarily include investments in common stock, which are valued based on unadjusted prices

for identical securities in active markets and are classified as Level 1. Equity securities also include commingled

funds, that are valued using a net asset value per share and are composed of equity securities traded publicly on

exchanges across multiple industry sectors in the U.S. and other regions of the world and are classified as Level 2.

Price quotes for the assets held by these funds are readily observable and available.

Debt securities are primarily composed of U.S. government and agency securities, municipal securities, and other

fixed-income securities, including corporate debt securities. U.S. government and agency securities primarily consist

of U.S. Treasury securities that are classified as Level 1 because the fair value is determined by observable market

prices in active markets. A market approach is generally used to estimate the fair value of debt securities classified as

Level 2 using evaluated pricing data, such as broker quotes, for similar securities adjusted for observable differences.

Significant inputs used in the valuation model generally include benchmark yield curves and issuer spreads. The

external credit ratings, coupon rate, and maturity of each security are considered in the valuation model, as

applicable.

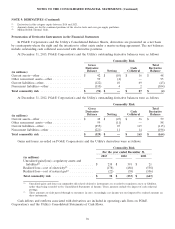

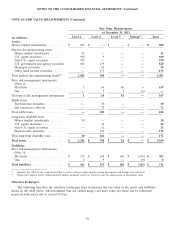

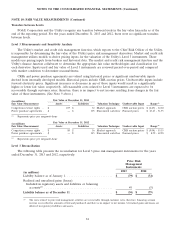

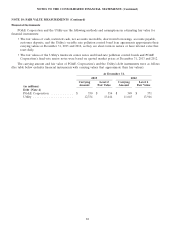

Price Risk Management Instruments

Price risk management instruments include physical and financial derivative contracts, such as power purchase

agreements, forwards, swaps, options, and CRRs that are traded either on an exchange or over-the-counter.

Power purchase agreements, forwards, and swaps are valued using a discounted cash flow model. Exchange-

traded forwards and swaps that are valued using observable market forward prices for the underlying commodity are

classified as Level 1. Over-the-counter forwards and swaps that are identical to exchange-traded forwards and swaps

or are valued using forward prices from broker quotes that are corroborated with market data are classified as

Level 2. Exchange-traded options are valued using observable market data and market-corroborated data and are

classified as Level 2. Long-dated power purchase agreements that are valued using significant unobservable data are

classified as Level 3. These Level 3 contracts are valued using either estimated basis adjustments from liquid trading

points or techniques, including extrapolation from observable prices, when a contract term extends beyond a period

for which market data is available.

The Utility holds CRRs to hedge the financial risk of CAISO-imposed congestion charges in the day-ahead

market. CRRs are valued based on prices observed in the CAISO auction, which are discounted at the risk-free rate.

Limited market data is available in the CAISO auction and between auction dates; therefore, the Utility uses models

to forecast CRR prices for those periods not covered in the auctions. CRRs are classified as Level 3.

Other Investments

Other investments in common stock are valued based on unadjusted prices for the investments and are actively

traded on public exchanges. These investments are therefore considered Level 1 assets.

80