PG&E 2013 Annual Report Download - page 64

Download and view the complete annual report

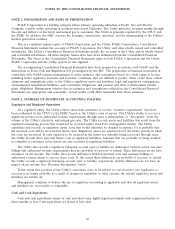

Please find page 64 of the 2013 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (Continued)

NOTE 2: SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

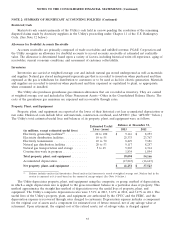

accumulated depreciation. The cost of repairs and maintenance, including planned major maintenance activities and

minor replacements of property, is charged to operating and maintenance expense as incurred.

AFUDC

AFUDC represents the estimated costs of debt (i.e., interest) and equity funds used to finance regulated plant

additions and is capitalized as part of the cost of construction. AFUDC is recoverable from customers through rates

over the life of the related property once the property is placed in service. AFUDC related to the cost of debt is

recorded as a reduction to interest expense. AFUDC related to the cost of equity is recorded in other income. The

Utility recorded AFUDC related to debt and equity, respectively, of $47 million and $101 million during 2013,

$49 million and $107 million during 2012, and $40 million and $87 million during 2011.

Asset Retirement Obligations

PG&E Corporation and the Utility record an ARO at discounted fair value in the period in which the obligation

is incurred if the discounted fair value can be reasonably estimated. In the same period, the associated asset

retirement costs are capitalized as part of the carrying amount of the related long-lived asset. In each subsequent

period, the ARO is accreted to its present value. PG&E Corporation and the Utility also record an ARO if a legal

obligation to perform an asset removal exists and can be reasonably estimated, but performance is conditional upon

a future event. The Utility recognizes timing differences between the recognition of costs and the costs recovered

through the ratemaking process as regulatory assets or liabilities. (See Note 3 below.) The Utility has an ARO

primarily for its nuclear generation facilities, certain fossil fuel-fired generation facilities, and gas transmission system

assets.

For the year ended December 31, 2013, the Utility recorded an increase of $596 million to its ARO. The

increase primarily reflects a higher expected cost per unit of transmission pipeline replacements.

Detailed studies of the cost to decommission the Utility’s nuclear generation facilities are conducted every three

years in conjunction with the Nuclear Decommissioning Cost Triennial Proceeding conducted by the CPUC. In

December 2012, the Utility submitted its updated decommissioning cost estimate with the CPUC. The estimated

undiscounted cost to decommission the Utility’s nuclear power plants increased by $1.4 billion in 2012 due to higher

spent nuclear fuel disposal costs and an increase in the scope of work. A significant portion of the increase in

decommissioning cost estimates is due to the need to develop on-site storage for spent nuclear fuel because the

federal government has failed to meet its obligation to develop a permanent repository for the disposal of nuclear

waste from nuclear facilities in the United States. The Utility expects that it will recover its future on-site storage

costs from the federal government. Recovered amounts will be refunded to customers through rates.

The estimated undiscounted nuclear decommissioning cost for the Utility’s nuclear generation facilities was

approximately $3.5 billion at December 31, 2013 and 2012, as filed in the 2012 triennial proceeding. In future dollars,

the estimated nuclear decommissioning cost is approximately $6.1 billion at December 31, 2013 and 2012. These

estimates are based on the 2012 decommissioning cost studies and are prepared in accordance with CPUC

requirements. The estimated nuclear decommissioning cost in future dollars is discounted for GAAP purposes and

recognized as an ARO on the Consolidated Balance Sheets. The total nuclear decommissioning obligation accrued in

accordance with GAAP was $2.5 billion at December 31, 2013 and 2012.

58