PG&E 2013 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2013 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (Continued)

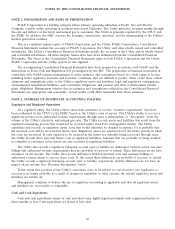

NOTE 2: SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

Variable Interest Entities

A VIE is an entity that does not have sufficient equity at risk to finance its activities without additional

subordinated financial support from other parties, or whose equity investors lack any characteristics of a controlling

financial interest. An enterprise that has a controlling financial interest in a VIE is known as the VIE’s primary

beneficiary and is required to consolidate the VIE. In determining whether consolidation of a particular entity is

required, PG&E Corporation and the Utility first evaluate whether the entity is a VIE. If the entity is a VIE, PG&E

Corporation and the Utility use a qualitative approach to determine if either is the primary beneficiary of the VIE.

Some of the counterparties to the Utility’s power purchase agreements are considered VIEs. Each of these VIEs

was designed to own a power plant that would generate electricity for sale to the Utility. To determine whether the

Utility was the primary beneficiary of any of these VIEs at December 31, 2013, it assessed whether it absorbs any of

the VIE’s expected losses or receives any portion of the VIE’s expected residual returns under the terms of the

power purchase agreement, analyzed the variability in the VIE’s gross margin, and considered whether it had any

decision-making rights associated with the activities that are most significant to the VIE’s performance, such as

dispatch rights and operating and maintenance activities. The Utility’s financial exposure is limited to the amount the

Utility pays for delivered electricity and capacity. The Utility did not have any decision-making rights associated with

any of the activities that are most significant to the economic performance of any of these VIEs. Since the Utility

was not the primary beneficiary of any of these VIEs at December 31, 2013, it did not consolidate any of them.

PG&E Corporation affiliates have entered into four tax equity agreements to fund residential and commercial

retail solar energy installations with four separate privately held funds that are considered VIEs. Under these

agreements, PG&E Corporation has made cumulative lease payments and investment contributions of $362 million

from 2010 to 2013 to these companies in exchange for the right to receive benefits from local rebates, federal grants,

and a share of the customer payments made to these companies. At December 31, 2013 and 2012, the carrying

amount of PG&E Corporation’s investment in these agreements was $98 million and $166 million, respectively.

PG&E Corporation has no material remaining commitment to fund these agreements. PG&E Corporation

determined that it does not have control over the companies’ significant economic activities, such as the design of the

companies, vendor selection, construction, and the ongoing operations of the companies. Since PG&E Corporation

was not the primary beneficiary of any of these VIEs at December 31, 2013, it did not consolidate any of them.

Other Accounting Policies

For other accounting policies impacting PG&E Corporation’s and the Utility’s consolidated financial statements,

see ‘‘Derivatives’’ in Note 9, ‘‘Fair Value Measurements’’ in Note 10, and ‘‘Contingencies’’ in Note 14 of the Notes to

the Consolidated Financial Statements.

Adoption of New Accounting Pronouncements

Reporting of Amounts Reclassified Out of Accumulated Other Comprehensive Income

In February 2013, the Financial Accounting Standards Board issued an ASU that requires an entity to provide

information about the amounts reclassified out of accumulated other comprehensive income. The ASU became

effective for PG&E Corporation and the Utility on January 1, 2013.

61