PG&E 2013 Annual Report Download - page 12

Download and view the complete annual report

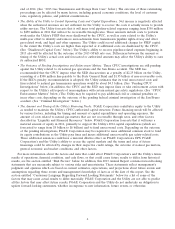

Please find page 12 of the 2013 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.end of 2014. (See ‘‘2015 Gas Transmission and Storage Rate Case’’ below.) The outcome of these ratemaking

proceedings can be affected by many factors, including general economic conditions, the level of customer

rates, regulatory policies, and political considerations.

•The Ability of the Utility to Control Operating Costs and Capital Expenditures. Net income is negatively affected

when the authorized revenues are not sufficient for the Utility to recover the costs it actually incurs to provide

utility services. The Utility forecasts that it will incur total pipeline-related expenses ranging from $350 million

to $450 million in 2014 that will not be recoverable through rates. These amounts include costs to perform

work under the Utility’s PSEP that were disallowed by the CPUC, as well as costs related to the Utility’s

multi-year effort to identify and remove encroachments from transmission pipeline rights-of-way and other

gas-related work, and legal and other expenses. The Utility could record additional charges for PSEP capital

to the extent the Utility’s costs are higher than expected or if additional costs are disallowed by the CPUC.

(See ‘‘Disallowed Capital Costs’’ below.) The Utility’s ability to recover pipeline-related expenses beginning in

2015 also will be affected by the outcome of the 2015 GT&S rate case. Differences between the amount or

timing of the Utility’s actual costs and forecasted or authorized amounts may affect the Utility’s ability to earn

its authorized ROE.

•The Outcome of Pending Investigations and Enforcement Matters. Three CPUC investigations are still pending

against the Utility related to its natural gas operations and the San Bruno accident. The SED has

recommended that the CPUC impose what the SED characterizes as a penalty of $2.25 billion on the Utility,

consisting of a $300 million fine payable to the State General Fund and $1.95 billion of non-recoverable costs.

If the SED’s penalty recommendation is adopted, the Utility estimates that its total unrecovered costs and

fines related to natural gas transmission operations would be about $4.5 billion. (See ‘‘Pending CPUC

Investigations’’ below.) In addition, the CPUC and the SED may impose fines or take enforcement action with

respect to the Utility’s self-reports of noncompliance with certain natural gas safety regulations. (See ‘‘CPUC

Enforcement Matters’’ below.) The Utility may be required to pay additional civil or criminal penalties or

incur other costs, depending on the outcome of the pending federal criminal investigation of the San Bruno

accident. (See ‘‘Criminal Investigation’’ below.)

•The Amount and Timing of the Utility’s Financing Needs. PG&E Corporation contributes equity to the Utility

as needed to maintain the Utility’s CPUC-authorized capital structure. Future financing needs will be affected

by various factors, including the timing and amount of capital expenditures and operating expenses, the

amount of costs related to natural gas matters that are not recoverable through rates, and other factors

described in ‘‘Liquidity and Financial Resources’’ below. PG&E Corporation forecasts that it will issue a

material amount of equity in 2014, primarily to support the Utility’s 2014 capital expenditures (which are

forecasted to range from $5 billion to $6 billion) and to fund unrecovered costs. Depending on the outcome

of the pending investigations, PG&E Corporation may be required to issue additional common stock to fund

its equity contributions as the Utility pays fines and incurs additional unrecoverable gas safety-related costs.

These additional issuances could have a material dilutive effect on PG&E Corporation’s EPS. PG&E

Corporation’s and the Utility’s ability to access the capital markets and the terms and rates of future

financings could be affected by changes in their respective credit ratings, the outcome of natural gas matters,

general economic and market conditions, and other factors.

For more information about the factors and risks that could affect PG&E Corporation’s and the Utility’s future

results of operations, financial condition, and cash flows, or that could cause future results to differ from historical

results, see the section entitled ‘‘Risk Factors’’ below. In addition, this 2013 Annual Report contains forward-looking

statements that are necessarily subject to various risks and uncertainties. These statements reflect management’s

judgment and opinions which are based on current estimates, expectations, and projections about future events and

assumptions regarding these events and management’s knowledge of facts as of the date of this report. See the

section entitled ‘‘Cautionary Language Regarding Forward Looking Statements’’ below for a list of some of the

factors that may cause actual results to differ materially. PG&E Corporation and the Utility are not able to predict

all the factors that may affect future results. PG&E Corporation and the Utility do not undertake an obligation to

update forward-looking statements, whether in response to new information, future events, or otherwise.

6