PG&E 2013 Annual Report Download - page 27

Download and view the complete annual report

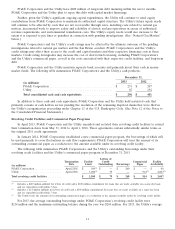

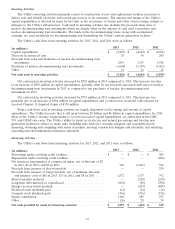

Please find page 27 of the 2013 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.and $168 million in 2017 for increasing capital expenditures and the associated growth in rate base, as well as

increasing costs of labor, materials, and other expenses. The Utility also has proposed eliminating the current

mechanism that subjects a portion of the Utility’s transportation-only revenue requirement to market risk, replacing

it with two-way balancing accounts to allow the Utility to record differences between billed revenues and the Utility’s

authorized revenue requirements. Any over-collections would be returned to customers and any under-collections

would be paid by customers, with no additional risk or benefit for shareholders.

The Utility has not requested rate recovery for certain costs it forecasts it will incur during 2015 through 2017.

These forecast costs include costs related to the Utility’s multi-year effort to identify and remove encroachments

from gas transmission pipeline rights-of-way, approximately $75 million over the three year period to pressure test

pipelines placed into service after 1961, and approximately $75 million of remedial costs associated with the Utility’s

pipeline corrosion control program over the three year period.

The Utility has requested that the CPUC issue a final decision by the end of 2014 so that any authorized

revenue requirement adjustments can become effective on January 1, 2015. If the CPUC has not yet issued a final

decision, then, in accordance with the CPUC’s decision in the Utility’s last GT&S rate case, there will be an

automatic 2% increase in rates on January 1, 2015 that will remain in effect until the CPUC issues a final decision in

the 2015 GT&S rate case. Given the significant revenue requirement increase the Utility has requested, the Utility

plans to ask the CPUC for an order to make any authorized revenue requirement changes effective on January 1,

2015, in the event that the CPUC issues its final decision after that date.

The Utility’s continued use of regulatory accounting under GAAP (which enables it to account for the effects of

regulation, including recording regulatory assets and liabilities) for gas transmission and storage service depends on

its ability to recover its cost of service. If the Utility were unable to continue using regulatory accounting under

GAAP, there would bedifferences in the timing of expense (or gain) recognition that could materially affect the

Utility’s future financial results.

Electric Transmission Owner Rate Cases

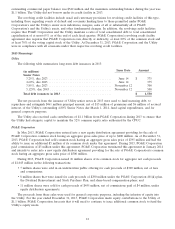

On January 17, 2014, the FERC approved the settlement of the Utility’s TO rate case that was filed in

September 2012. Under the settlement the Utility’s annual retail revenue requirement was increased from

$934 million to $1,017 million effective as of May 1, 2013. The Utility has collected revenues between May 1 and

September 30, 2013 at the higher as-filed rates requested in the Utility’s application. The Utility will refund to

customers the difference between revenues collected at the higher as-filed rates and the rates set in the

FERC-approved settlement agreement.

On September 24, 2013, the FERC accepted the Utility’s TO rate case that the Utility filed on July 24, 2013,

making the proposed rates effective October 1, 2013, subject to refund, pending a final decision by the FERC. The

Utility requested a retail revenue requirement of $1,072 million and an ROE of 10.9%. The proposed rates represent

a $55 million increase to the annual revenue requirement set in the FERC-approved settlement agreement described

in the preceding paragraph. Hearings are currently being held in abeyance while settlement discussions are held.

Oakley Generation Facility

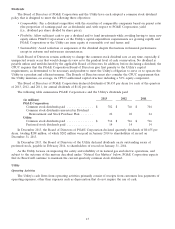

In December 2012, the CPUC approved an amended purchase and sale agreement between the Utility and a

third-party developer that provides for the construction of a 586-megawatt natural gas-fired facility in Oakley,

California. The CPUC authorized the Utility to recover the purchase price through rates. The CPUC’s denial of

various applications for rehearing that had been filed with respect to its December 2012 decision was appealed to the

California Court of Appeal. On February 5, 2014, the California Court of Appeal issued a ruling that annulled the

CPUC’s decision after the court determined that the evidence presented did not support a finding of need for the

Oakley facility. The Utility is reviewing the court’s decision.

Diablo Canyon Nuclear Power Plant

In 2009, the Utility filed an application with the NRC to renew the operating licenses for the two operating units

at Diablo Canyon. (The current licenses expire in 2024 and 2025.) In May 2011, after an earthquake and resulting

tsunami that caused significant damage to the Fukushima-Dai-ichi nuclear facilities in Japan, the NRC granted the

Utility’s request to delay processing the Utility’s application while certain advanced seismic studies were completed

by the Utility. The Utility is currently assessing the data from recently completed advanced seismic studies along with

other available seismic data. The Utility will not make any decisions about whether to request that the NRC resume

21