PG&E 2013 Annual Report Download - page 66

Download and view the complete annual report

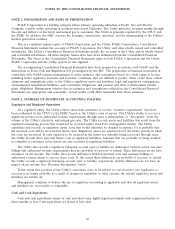

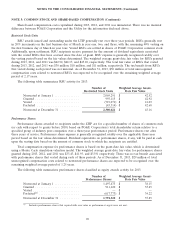

Please find page 66 of the 2013 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (Continued)

NOTE 2: SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

CPUC in these rates cases is independent, or ‘‘decoupled’’ from the volume of the Utility’s sales of electricity and

natural gas services. The Utility recognizes revenues once they have been authorized for rate recovery, amounts are

objectively determinable and probable of recovery, and amounts are expected to be collected within 24 months.

Generally, the revenue is recognized ratably over the year.

The CPUC also has authorized the Utility to collect additional revenue requirements to recover costs that the

Utility has been authorized to pass on to customers, including costs to purchase electricity and natural gas; and to

fund public purpose, demand response, and customer energy efficiency programs. Generally, the revenue recognition

criteria for pass-through costs billed to customers are met at the time the costs are incurred.

The FERC authorizes the Utility’s revenue requirements in periodic (often annual) TO rate cases. The Utility’s

ability to recover revenue requirements authorized by the FERC is dependent on the volume of the Utility’s

electricity sales, and revenue is recognized only for amounts billed and unbilled.

The Utility’s revenues and net income can be affected by incentive ratemaking mechanisms that adjust rates

depending on the extent to which the Utility meets certain performance criteria.

Income Taxes

PG&E Corporation and the Utility use the liability method of accounting for income taxes. The income tax

provision includes current and deferred income taxes resulting from operations during the year. PG&E Corporation

and the Utility estimate current period tax expense in addition to calculating deferred tax assets and liabilities.

Deferred tax assets and liabilities result from temporary tax and accounting timing differences, such as those arising

from depreciation expense. (See Note 8 below.)

PG&E Corporation and the Utility recognize a tax benefit if it is more likely than not that a tax position taken

or expected to be taken in a tax return will be sustained upon examination by taxing authorities based on the merits

of the position. The tax benefit recognized in the financial statements is measured based on the largest amount of

benefit that is greater than 50% likely of being realized upon settlement. As such, the difference between a tax

position taken or expected to be taken in a tax return in future periods and the benefit recognized and measured

pursuant to this guidance represents an unrecognized tax benefit.

Investment tax credits are deferred and amortized to income over time. The Utility amortizes its investment tax

credits over the life of the related property in accordance with regulatory treatment. PG&E Corporation amortizes

its investment tax credits over the projected investment recovery period.

PG&E Corporation files a consolidated U.S. federal income tax return that includes the Utility and domestic

subsidiaries in which its ownership is 80% or more. PG&E Corporation files a combined state income tax return in

California. PG&E Corporation and the Utility are parties to a tax-sharing agreement under which the Utility

determines its income tax provision (benefit) on a stand-alone basis.

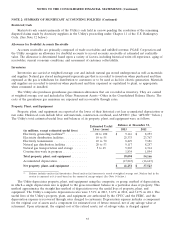

Nuclear Decommissioning Trusts

The Utility’s nuclear generation facilities consist of two units at Diablo Canyon and the retired facility at

Humboldt Bay. Nuclear decommissioning requires the safe removal of a nuclear generation facility from service and

the reduction of residual radioactivity to a level that permits termination of the NRC license and release of the

property for unrestricted use. The Utility’s nuclear decommissioning costs are recovered from customers through

rates and are held in trusts until authorized for release by the CPUC.

The Utility classifies its investments held in the nuclear decommissioning trusts as ‘‘available-for-sale.’’ Since the

Utility’s nuclear decommissioning trust assets are managed by external investment managers, the Utility does not

have the ability to sell its investments at its discretion. Therefore, all unrealized losses are considered

other-than-temporary impairments. Gains or losses on the nuclear decommissioning trust investments are refundable

or recoverable, respectively, from customers through rates. Therefore, trust earnings are deferred and included in the

regulatory liability for recoveries in excess of the ARO. There is no impact on the Utility’s earnings or accumulated

other comprehensive income. The cost of debt and equity securities sold by the trust is determined by specific

identification.

60