PG&E 2013 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2013 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

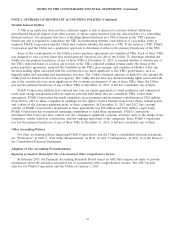

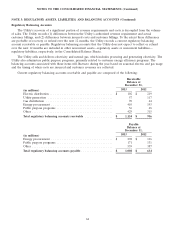

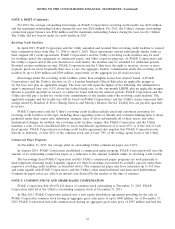

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (Continued)

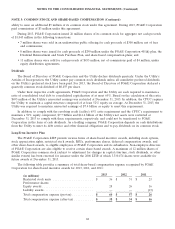

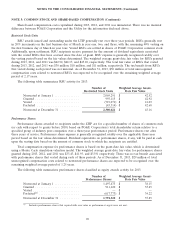

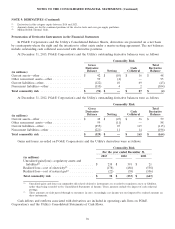

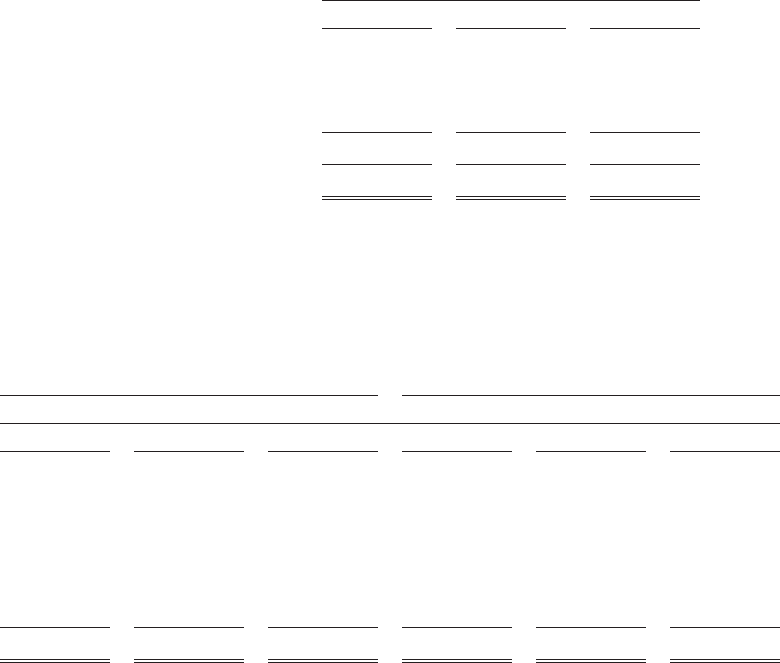

NOTE 7: EARNINGS PER SHARE

PG&E Corporation’s basic EPS is calculated by dividing the income available for common shareholders by the

weighted average number of common shares outstanding. PG&E Corporation applies the treasury stock method of

reflecting the dilutive effect of outstanding share-based compensation in the calculation of diluted EPS. The

following is a reconciliation of PG&E Corporation’s income available for common shareholders and weighted

average common shares outstanding for calculating diluted EPS for 2013, 2012 and 2011.

Year Ended December 31,

2013 2012 2011

(in millions, except per share amounts)

Income available for common shareholders ....... $ 814 $ 816 $ 844

Weighted average common shares outstanding, basic 444 424 401

Add incremental shares from assumed conversions:

Employee share-based compensation ...........111

Weighted average common share outstanding, diluted 445 425 402

Total earnings per common share, diluted ........ $ 1.83 $ 1.92 $ 2.10

For each of the periods presented above, the calculation of outstanding common shares on a diluted basis

excluded an insignificant amount of options and securities that were antidilutive.

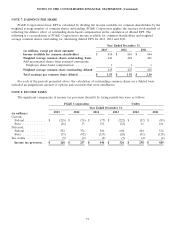

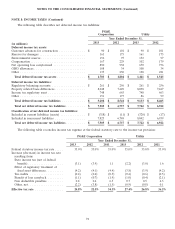

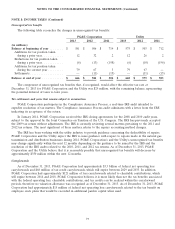

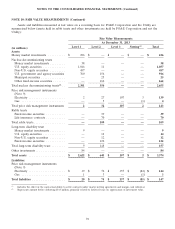

NOTE 8: INCOME TAXES

The significant components of income tax provision (benefit) by taxing jurisdiction were as follows:

PG&E Corporation Utility

Year Ended December 31,

2013 2012 2011 2013 2012 2011

(in millions)

Current:

Federal ............ $ (218) $ (74) $ (77) $ (222) $ (52) $ (83)

State ............. (26) 33 152 (23) 41 161

Deferred:

Federal ............ 552 374 504 604 404 534

State ............. (35) (92) (135) (28) (91) (128)

Tax credits ........... (5) (4) (4) (5) (4) (4)

Income tax provision .. $ 268 $ 237 $ 440 $ 326 $ 298 $ 480

71