PG&E 2013 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2013 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

of PG&E Corporation and the Utility should be read in conjunction with the Consolidated Financial Statements and

the Notes to the Consolidated Financial Statements included in this annual report.

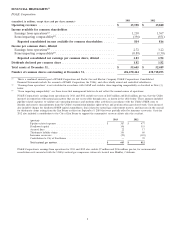

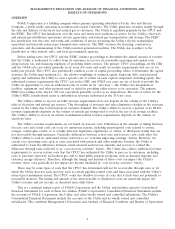

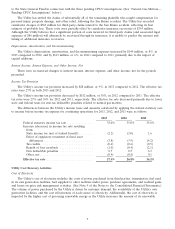

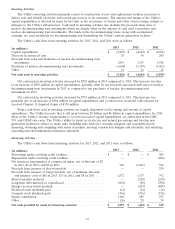

Summary of Changes in Net Income and Earnings per Share

PG&E Corporation’s net income available for common shareholders for 2013 was $814 million, or $1.83 per

share, as compared to $816 million, or $1.92 per share, for 2012. Operating results have continued to be materially

affected by costs the Utility has incurred to improve the safety and reliability of its natural gas operations that are

not recoverable through rates. These unrecovered costs have increased the Utility’s equity needs which PG&E

Corporation has funded through equity issuances that have materially diluted PG&E Corporation’s EPS.

The following table is a summary reconciliation of the key changes, after-tax, in PG&E Corporation’s income

available for common shareholders and EPS for the year ended December 31, 2013 compared to the prior year. (See

‘‘Results of Operations’’ and ‘‘Natural Gas Matters’’ below for additional information.)

EPS

Earnings (Diluted)

(in millions, except per share amounts)

Income Available for Common Shareholders—2012 ...................... $ 816 $ 1.92

Natural gas matters(1) .......................................... 96 0.27

Growth in rate base earnings(2) ................................... 87 0.19

Environmental-related costs(3) .................................... 59 0.14

Reduction in authorized cost of capital(4) ............................ (166) (0.37)

Impact of capital spending over authorized(5) ......................... (24) (0.06)

Uneconomic project and lease termination(6) ......................... (11) (0.03)

Gas transmission revenues ...................................... (9) (0.02)

Increase in shares outstanding(7) .................................. — (0.15)

Other ..................................................... (34) (0.06)

Income Available for Common Shareholders—2013 ...................... $ 814 $ 1.83

(1) The Utility incurred net costs and capital charges related to natural gas matters of $645 million and $812 million, pre-tax, during 2013 and

2012, respectively. These amounts are not recoverable through rates. See ‘‘Operating and Maintenance’’ below.

(2) Represents the impact of the increase in rate base as authorized in various rate cases during 2013 as compared to 2012.

(3) Environmental-related costs were lower in 2013 compared to 2012 when the Utility incurred a significant charge for environmental

remediation associated with the Hinkley natural gas compressor site.

(4) Reflects the lower cost of capital authorized in the 2013 Cost of Capital proceeding. The CPUC authorized the Utility to earn a ROE of

10.40% (compared to 11.35% previously authorized) and adjusted its cost of debt beginning on January 1, 2013.

(5) Represents the incremental interest and depreciation expense associated with capital expenditures that exceed the current authorized levels.

(6) Represents the expenses incurred in 2013 for terminated projects and leases, compared to 2012.

(7) Represents the impact of a higher number of weighted average shares outstanding during 2013, compared to 2012. PG&E Corporation issues

shares to fund its equity contributions to the Utility to maintain the Utility’s capital structure and fund operations, including expenses related

to natural gas matters. This has no dollar impact on earnings.

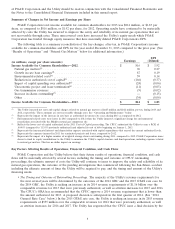

Key Factors Affecting Results of Operations, Financial Condition, and Cash Flows

PG&E Corporation and the Utility believe that their future results of operations, financial condition, and cash

flows will be materially affected by several factors, including the timing and outcome of CPUC ratemaking

proceedings, the ultimate amount of costs the Utility will continue to incur to improve the safety and reliability of its

natural gas operations, the outcome of the pending investigations that commenced following the San Bruno accident

including the ultimate amount of fines the Utility will be required to pay, and the timing and amount of the Utility’s

financing needs.

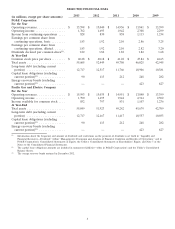

•The Timing and Outcome of Ratemaking Proceedings. The majority of the Utility’s revenue requirements for

the next several years will be determined by the outcomes of the 2014 GRC and the 2015 GT&S rate case. In

the 2014 GRC, the Utility is seeking an increase in its 2014 revenue requirements of $1.16 billion over the

comparable revenues for 2013 that were previously authorized, as well as attrition increases for 2015 and 2016.

The CPUC’s ORA has recommended that the CPUC approve a 2014 revenue requirement that is lower than

the amount authorized for 2013. A proposed decision is anticipated in the first quarter of 2014. (See ‘‘2014

General Rate Case’’ below.) In the 2015 GT&S rate case, the Utility is seeking an increase in its 2015 revenue

requirements of $555 million over the comparable revenues for 2014 that were previously authorized, as well

as attrition increases for 2016 and 2017. The Utility has requested that the CPUC issue a final decision by the

5