PG&E 2013 Annual Report Download - page 30

Download and view the complete annual report

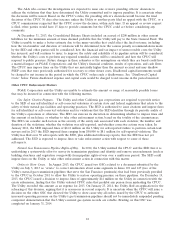

Please find page 30 of the 2013 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.California Water Board in 2014. If the California Water Board requires the installation of cooling towers that the

Utility believes are not technically or economically feasible, the Utility may be forced to cease operations at Diablo

Canyon and may incur a material charge. Even if the Utility is not required to install cooling towers, it could incur

significant costs to comply with alternative compliance measures or to make payments to support various

environmental mitigation projects. The Utility would seek to recover such costs in rates. The Utility’s Diablo Canyon

operations must be in compliance with the California Water Board’s policy by December 31, 2024.

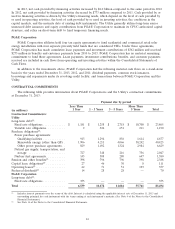

OFF-BALANCE SHEET ARRANGEMENTS

PG&E Corporation and the Utility do not have any off-balance sheet arrangements that have had, or are

reasonably likely to have, a current or future material effect on their financial condition, changes in financial

condition, revenues or expenses, results of operations, liquidity, capital expenditures, or capital resources, other than

those discussed in Note 2 (PG&E Corporation’s tax equity financing agreements) and Note 14 of the Notes to the

Consolidated Financial Statements (the Utility’s commodity purchase agreements).

RISK MANAGEMENT ACTIVITIES

The Utility and PG&E Corporation, mainly through its ownership of the Utility, are exposed to market risk,

which is the risk that changes in market conditions will adversely affect net income or cash flows. PG&E Corporation

and the Utility face market risk associated with their operations; their financing arrangements; the marketplace for

electricity, natural gas, electric transmission, natural gas transportation, and storage; emissions allowances, other

goods and services; and other aspects of their businesses. PG&E Corporation and the Utility categorize market risks

as ‘‘price risk’’ and ‘‘interest rate risk.’’ The Utility is also exposed to ‘‘credit risk,’’ the risk that counterparties fail to

perform their contractual obligations.

The Utility actively manages market risk through risk management programs designed to support business

objectives, discourage unauthorized risk-taking, reduce commodity cost volatility, and manage cash flows. The Utility

uses derivative instruments only for non-trading purposes (i.e., risk mitigation) and not for speculative purposes. The

Utility’s risk management activities include the use of energy and financial instruments such as forward contracts,

futures, swaps, options, and other instruments and agreements, most of which are accounted for as derivative

instruments. Some contracts are accounted for as leases.

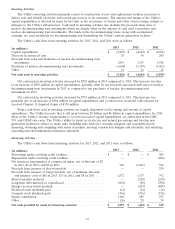

Commodity Price Risk

The Utility is exposed to commodity price risk as a result of its electricity and natural gas procurement activities,

including the procurement of natural gas and nuclear fuel necessary for electricity generation and natural gas

procurement for core customers. As long as the Utility can conclude that it is probable that its reasonably incurred

wholesale electricity procurement costs and natural gas costs are recoverable, fluctuations in electricity and natural

gas prices will not affect earnings. Such fluctuations, however, may impact cash flows. The Utility’s natural gas

transportation and storage costs for core customers are also fully recoverable through a ratemaking mechanism.

The Utility’s natural gas transportation and storage costs for non-core customers may not be fully recoverable.

The Utility is subject to price and volumetric risk for the portion of intrastate natural gas transportation and storage

capacity that has not been sold under long-term contracts providing for the recovery of all fixed costs through the

collection of fixed reservation charges. The Utility sells most of its capacity based on the volume of gas that the

Utility’s customers actually ship, which exposes the Utility to volumetric risk.

The Utility uses value-at-risk to measure its shareholders’ exposure to price and volumetric risks resulting from

variability in the price of, and demand for, natural gas transportation and storage services that could impact revenues

due to changes in market prices and customer demand. The Utility’s value-at-risk calculated under the methodology

described above was approximately $14 million and $13 million at December 31, 2013 and 2012, respectively. During

the 12 months ended December 31, 2013, the Utility’s approximate high, low, and average values-at-risk were

$14 million, $9 million and $12 million, respectively. During 2012, the value-at-risk amounts were $13 million,

$10 million and $12 million, respectively. (See Note 9 of the Notes to the Consolidated Financial Statements for

further discussion of price risk management activities.)

24