PG&E 2013 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2013 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

OVERVIEW

PG&E Corporation is a holding company whose primary operating subsidiary is Pacific Gas and Electric

Company, a public utility operating in northern and central California. The Utility generates revenues mainly through

the sale and delivery of electricity and natural gas to customers. The Utility is regulated primarily by the CPUC and

the FERC. The CPUC has jurisdiction over the rates and terms and conditions of service for the Utility’s electricity

and natural gas distribution operations, electric generation, and natural gas transportation and storage. The FERC

has jurisdiction over the rates and terms and conditions of service governing the Utility’s electric transmission

operations and interstate natural gas transportation contracts. The NRC oversees the licensing, construction,

operation, and decommissioning of the Utility’s nuclear generation facilities. The Utility also is subject to the

jurisdiction of other federal, state, and local governmental agencies.

Before setting rates, the CPUC and the FERC conduct proceedings to determine the annual amount of revenue

that the Utility is authorized to collect from its customers to recover its reasonable operating and capital costs

(depreciation, tax, and financing expenses) of providing utility services. The primary CPUC proceedings are the GRC

and the GT&S rate case which generally occur every few years and result in revenue requirements that are set for

multi-year periods. The CPUC also periodically conducts a cost of capital proceeding, where it determines the capital

structure the Utility must maintain (i.e., the relative weightings of common equity, long-term debt, and preferred

equity) and authorizes the Utility to earn a specific rate of return on each capital component, including equity. The

authorized revenue requirements the CPUC sets in the GRC and GT&S rate cases are set at levels to provide the

Utility an opportunity to earn its authorized rates of return on its ‘‘rate base’’—the Utility’s net investment in

facilities, equipment, and other property used or useful in providing utility service to its customers. The primary

FERC proceeding is the electric TO rate case which generally occurs on an annual basis. The rate of return for the

Utility’s FERC jurisdictional assets is embedded in revenues authorized in the TO rate cases.

The Utility’s ability to recover its GRC revenue requirements does not depend on the volume of the Utility’s

sales of electricity and natural gas services. This decoupling of revenues and sales eliminates volatility in the revenues

earned by the Utility due to fluctuations in customer demand. The Utility’s ability to recover a portion of its GT&S

revenue requirements depends on the volume of natural gas transported as well as the use of its storage facilities.

The Utility’s ability to recover its electric transmission-related revenue requirements depends on the volume of

electricity sales.

The Utility’s revenue requirements are set based on forecast costs. Differences in the amount or timing between

forecast costs and actual costs can occur for numerous reasons, including unanticipated costs related to storms,

outages, catastrophic events, or to comply with new legislation, regulations, or orders; or third-party claims that are

not recoverable through insurance. Generally, differences between actual costs and forecast costs could affect the

Utility’s ability to earn its authorized return (referred to as ‘‘activities impacting earnings’’ below). However, for

certain core operating costs, such as costs associated with pension and other employee benefits, the Utility is

authorized to track the difference between actual amounts and forecast amounts and recover or refund the

difference through rates (referred to as ‘‘cost recovery activities’’ below). The Utility also collects additional revenue

requirements to recover certain costs that the CPUC has authorized the Utility to pass on to customers, including

costs to purchase electricity and natural gas; and to fund public purpose programs, such as demand response and

customer energy efficiency. Therefore, although the timing and amount of these costs can impact the Utility’s

revenue, these costs generally do not impact net income (included in ‘‘cost recovery activities’’ below).

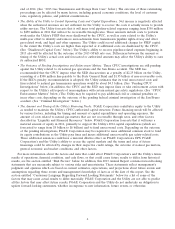

There may be some types of costs that the CPUC has determined will not be recoverable through rates or for

which the Utility does not seek recovery, such as certain pipeline-related costs and fines associated with the Utility’s

natural gas transmission system. The CPUC could also disallow recovery of costs that it finds were not prudently or

reasonably incurred. The timing and amount of the unrecoverable or disallowed costs can materially impact the

Utility’s revenue and net income, as described more fully below.

This is a combined annual report of PG&E Corporation and the Utility, and includes separate Consolidated

Financial Statements for each of these two entities. PG&E Corporation’s Consolidated Financial Statements include

the accounts of PG&E Corporation, the Utility, and other wholly owned and controlled subsidiaries. The Utility’s

Consolidated Financial Statements include the accounts of the Utility and its wholly owned and controlled

subsidiaries. This combined Management’s Discussion and Analysis of Financial Condition and Results of Operations

4