PG&E 2013 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2013 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (Continued)

NOTE 9: DERIVATIVES (Continued)

natural gas prices. To reduce the volatility in customer rates, the Utility may enter into financial instruments, such as

futures, options, or swaps. The Utility also enters into fixed-price forward contracts for natural gas to reduce future

cash flow variability from fluctuating natural gas prices. These instruments are considered derivatives.

Natural Gas Procurement (Core Gas Supply Portfolio)

The Utility enters into physical natural gas commodity contracts to fulfill the needs of its residential and smaller

commercial customers known as ‘‘core’’ customers. The Utility does not procure natural gas for industrial and large

commercial, or ‘‘non-core,’’ customers. Changes in temperature cause natural gas demand to vary daily, monthly, and

seasonally. Consequently, varying volumes of natural gas may be purchased or sold in the multi-month, monthly, and

to a lesser extent, daily spot market to balance such seasonal supply and demand. The Utility purchases financial

instruments, such as futures, swaps and options, as part of its core winter hedging program in order to manage

customer exposure to high natural gas prices during peak winter months. These financial instruments are considered

derivatives.

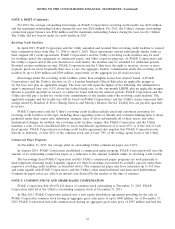

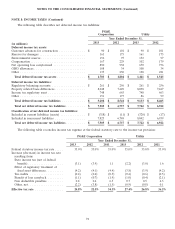

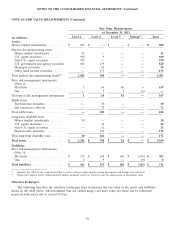

Volume of Derivative Activity

At December 31, 2013, the volumes of PG&E Corporation’s and the Utility’s outstanding derivatives were as

follows:

Contract Volume(1)

1 Year or 3 Years or

Greater but Greater but

Underlying Less Than Less Than Less Than 5 Years or

Product Instruments 1 Year 3 Years 5 Years Greater(2)

Natural Gas(3) .... Forwards and Swaps 243,213,288 79,735,000 8,892,500 —

(MMBtus(4))

Options 169,123,208 87,689,708 3,450,000 —

Electricity ....... Forwards and Swaps 2,537,023 2,009,505 2,008,046 1,534,695

(Megawatt-

hours)

Congestion Revenue Rights 73,510,440 83,747,782 63,718,517 29,945,852

(1) Amounts shown reflect the total gross derivative volumes by commodity type that are expected to settle in each period.

(2) Derivatives in this category expire between 2019 and 2022.

(3) Amounts shown are for the combined positions of the electric fuels and core gas supply portfolios.

(4) Million British Thermal Units.

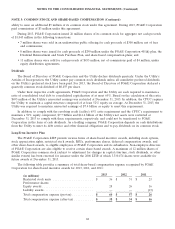

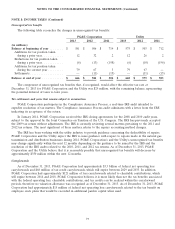

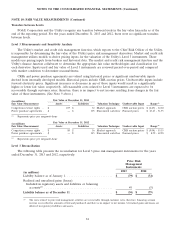

At December 31, 2012, the volumes of PG&E Corporation’s and the Utility’s outstanding derivatives were as

follows:

Contract Volume(1)

1 Year or 3 Years or

Greater but Greater but

Underlying Less Than Less Than Less Than 5 Years or

Product Instruments 1 Year 3 Years 5 Years Greater(2)

Natural Gas(3) .... Forwards and Swaps 329,466,510 98,628,398 5,490,000 —

(MMBtus(4))

Options 221,587,431 216,279,767 10,050,000 —

Electricity ....... Forwards and Swaps 2,537,023 3,541,046 2,009,505 2,538,718

(Megawatt-

hours)

Options — 239,015 239,233 119,508

Congestion Revenue Rights 74,198,690 74,187,803 74,240,147 25,699,804

(1) Amounts shown reflect the total gross derivative volumes by commodity type that are expected to settle in each period.

75