PG&E 2013 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2013 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (Continued)

NOTE 11: EMPLOYEE BENEFIT PLANS (Continued)

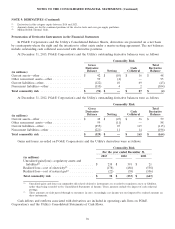

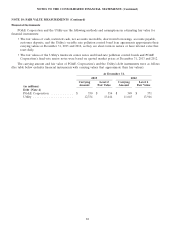

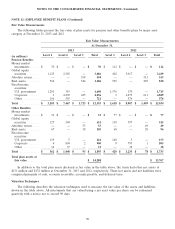

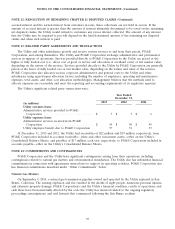

Change in Plan Assets, Benefit Obligations, and Funded Status

The following tables show the reconciliation of changes in plan assets, benefit obligations, and the plans’

aggregate funded status for pension benefits and other benefits for PG&E Corporation during 2013 and 2012:

Pension Benefits

2013 2012

(in millions)

Change in plan assets:

Fair value of plan assets at January 1 ...................... $ 12,141 $ 10,993

Actual return on plan assets .............................. 673 1,488

Company contributions ................................. 323 282

Benefits and expenses paid .............................. (610) (622)

Fair value of plan assets at December 31 .................... $ 12,527 $ 12,141

Change in benefit obligation:

Projected benefit obligation at January 1 .................... $ 15,541 $ 14,000

Service cost for benefits earned ........................... 468 396

Interest cost ......................................... 627 658

Actuarial (gain) loss ................................... (1,950) 1,099

Plan amendments ..................................... — 9

Transitional costs ...................................... 1 1

Benefits and expenses paid .............................. (610) (622)

Projected benefit obligation at December 31(1) ................. $ 14,077 $ 15,541

Funded status:

Current liability ....................................... $ (6) $ (6)

Noncurrent liability .................................... (1,544) (3,394)

Accrued benefit cost at December 31 ....................... $ (1,550) $ (3,400)

(1) PG&E Corporation’s accumulated benefit obligation was $12,659 million and $13,778 million at December 31, 2013 and 2012,

respectively.

85