PG&E 2013 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2013 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120

|

|

22FEB201408182366

PG&E Corporation common stock is traded on the New York Stock Exchange. The official New York Stock

Exchange symbol for PG&E Corporation is ‘‘PCG.’’

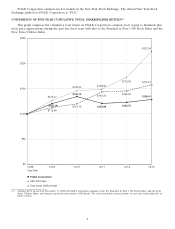

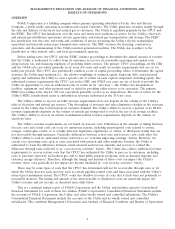

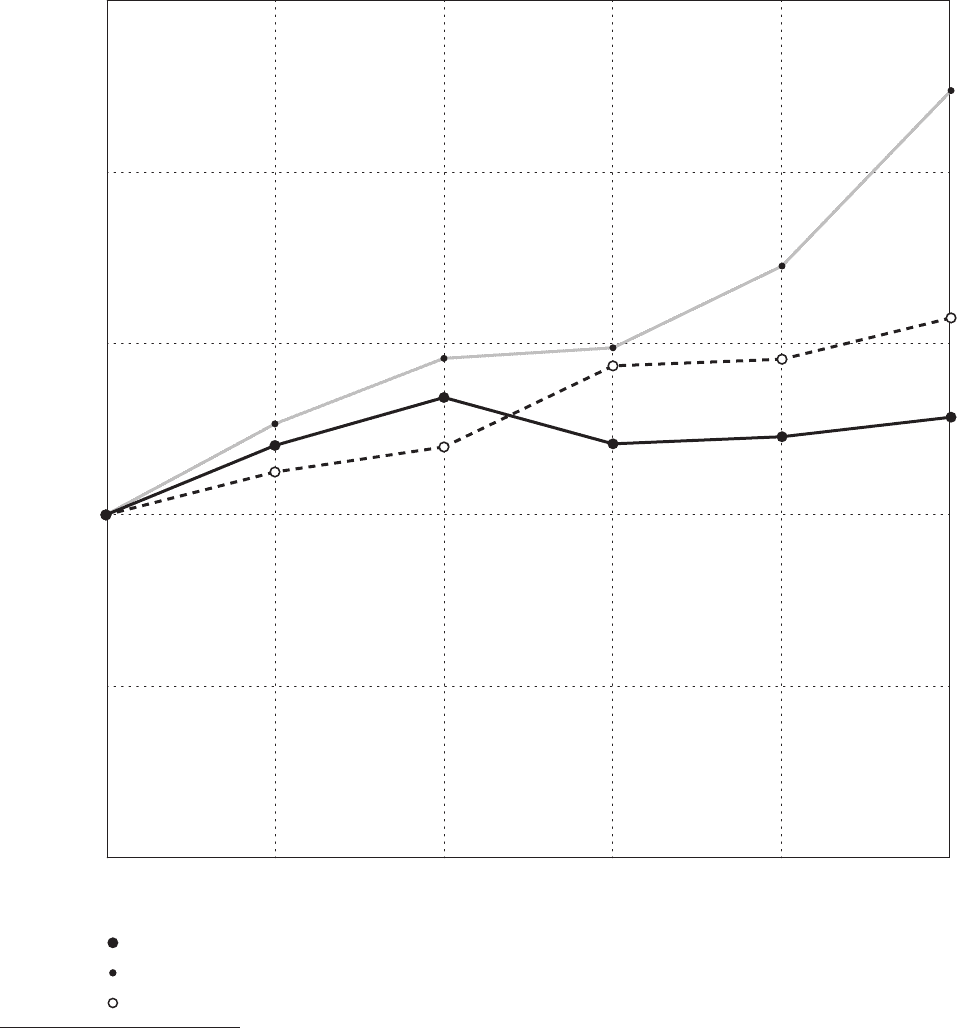

COMPARISON OF FIVE-YEAR CUMULATIVE TOTAL SHAREHOLDER RETURN(1)

This graph compares the cumulative total return on PG&E Corporation common stock (equal to dividends plus

stock price appreciation) during the past five fiscal years with that of the Standard & Poor’s 500 Stock Index and the

Dow Jones Utilities Index.

$0

12/08

Year End

12/09 12/10 12/11 12/1312/12

$50

$100

$150

$250

$200

Dow Jones Utilities Index

PG&E Corporation

S&P 500 Index

$126.47

$145.52

$172.35

$223.36

$120.19

$134.14

$120.66 $122.73

$128.41

$112.48

$143.33 $145.26

$157.27

$119.75

$148.59

(1) Assumes $100 invested on December 31, 2008 in PG&E Corporation common stock, the Standard & Poor’s 500 Stock Index, and the Dow

Jones Utilities Index, and assumes quarterly reinvestment of dividends. The total shareholder returns shown are not necessarily indicative of

future returns.

2