PG&E 2013 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2013 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (Continued)

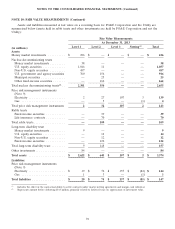

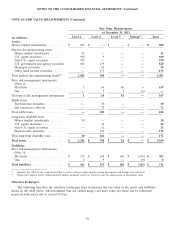

NOTE 10: FAIR VALUE MEASUREMENTS (Continued)

Financial Instruments

PG&E Corporation and the Utility use the following methods and assumptions in estimating fair value for

financial instruments:

• The fair values of cash, restricted cash, net accounts receivable, short-term borrowings, accounts payable,

customer deposits, and the Utility’s variable rate pollution control bond loan agreements approximate their

carrying values at December 31, 2013 and 2012, as they are short-term in nature or have interest rates that

reset daily.

• The fair values of the Utility’s fixed-rate senior notes and fixed-rate pollution control bonds and PG&E

Corporation’s fixed-rate senior notes were based on quoted market prices at December 31, 2013 and 2012.

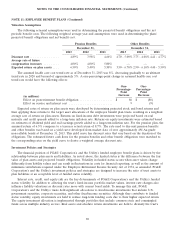

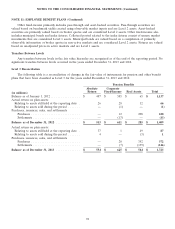

The carrying amount and fair value of PG&E Corporation’s and the Utility’s debt instruments were as follows

(the table below excludes financial instruments with carrying values that approximate their fair values):

At December 31,

2013 2012

Carrying Level 2 Carrying Level 2

Amount Fair Value Amount Fair Value

(in millions)

Debt (Note 4)

PG&E Corporation ............. $ 350 $ 354 $ 349 $ 371

Utility ....................... 12,334 13,444 11,645 13,946

82