PG&E 2013 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2013 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (Continued)

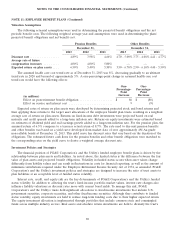

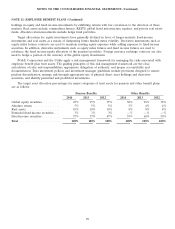

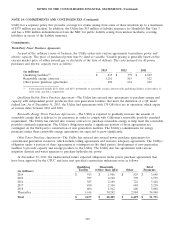

NOTE 11: EMPLOYEE BENEFIT PLANS (Continued)

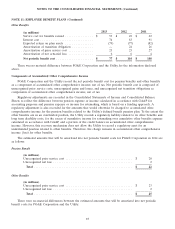

Defined Contribution Benefit Plans

PG&E Corporation sponsors employee retirement savings plans, including a defined contribution savings plan

that is qualified as a 401(k) plan under the Internal Revenue Code 1986, as amended. These plans permit eligible

employees to defer compensation, to make pre-tax and after-tax contributions, and provide for employer

contributions to be made to eligible participants. Employer contribution expense reflected in PG&E Corporation’s

Consolidated Statements of Income was as follows:

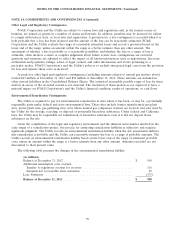

(in millions)

Year ended December 31,

2013 ........................................................ $ 71

2012 ........................................................ 67

2011 ........................................................ 65

There were no material differences between the employer contribution expense for PG&E Corporation and the

Utility for the years presented above.

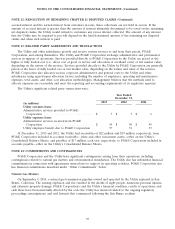

NOTE 12: RESOLUTION OF REMAINING CHAPTER 11 DISPUTED CLAIMS

Various electricity suppliers filed claims in the Utility’s proceeding filed under Chapter 11 of the U.S.

Bankruptcy Code seeking payment for energy supplied to the Utility’s customers between May 2000 and June 2001.

These claims, which the Utility disputes, are being addressed in various FERC and judicial proceedings in which the

State of California, the Utility, and other electricity purchasers are seeking refunds from electricity suppliers,

including governmental entities, for overcharges incurred in the CAISO and the California Power Exchange

wholesale electricity markets during this period.

While the FERC and judicial proceedings are pending, the Utility has pursued, and continues to pursue,

settlements with electricity suppliers. The Utility entered into a number of settlement agreements with various

electricity suppliers to resolve some of these disputed claims and to resolve the Utility’s refund claims against these

electricity suppliers. These settlement agreements provide that the amounts payable by the parties are, in some

instances, subject to adjustment based on the outcome of the various refund offset and interest issues being

considered by the FERC. The Utility is uncertain when and how the remaining disputed claims will be resolved.

Any net refunds, claim offsets, or other credits that the Utility receives from electricity suppliers through

resolution of the remaining disputed claims, either through settlement or through the conclusion of the various

FERC and judicial proceedings, are refunded to customers through rates in future periods.

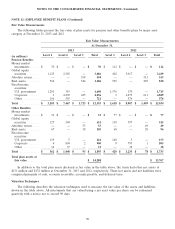

The following table presents the changes in the remaining net disputed claims liability, which includes interest:

(in millions)

Balance at December 31, 2012 ....................................... $ 842

Interest accrued, net of settlement .................................... 25

Less: supplier settlements-principal amount .............................. (3)

Balance at December 31, 2013 ....................................... $ 864

At December 31, 2013 and 2012, the remaining net disputed claims liability consisted of $154 million and

$157 million, respectively, of remaining net disputed claims (classified on the Consolidated Balance Sheets within

accounts payable—disputed claims and customer refunds) and $710 million and $685 million, respectively, of accrued

interest (classified on the Consolidated Balance Sheets within interest payable).

At December 31, 2013 and 2012, the Utility held $291 million, respectively, in escrow, including earned interest,

for payment of the remaining net disputed claims liability. These amounts are included within restricted cash on the

Consolidated Balance Sheets.

Interest accrues on the remaining net disputed claims at the FERC-ordered rate, which is higher than the rate

earned by the Utility on the escrow balance. Although the Utility has been collecting the difference between the

94