JCPenney 2015 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2015 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

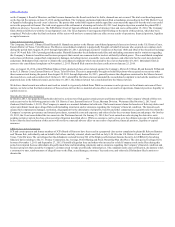

on the Company’s Board of Directors, and that because demand on the Board would not be futile, demand was not excused. The trial court heard arguments

on the Special Exceptions on June 25, 2012 and denied them. The Company and named individuals filed a mandamus proceeding in the Fifth District Court

of Appeals challenging the trial court’s decision. The parties then settled the litigation and the appellate court stayed the appeal so that the trial court could

review the proposed settlement. The trial court approved the settlement at a hearing on October 28, 2013 and, despite objection, awarded the plaintiff $3.1

million in attorneys’ fees and costs. The Fifth District Court of Appeals affirmed the award of attorneys' fees and costs on December 19, 2014. The Company

filed a Petition for Review with the Texas Supreme Court. The Texas Supreme Court requested full briefing on the merits of this petition, which has been

completed. We believe that the final resolution of this action will not have a material adverse effect on our results of operations, financial position, liquidity

or capital resources.

The Company, Myron E. Ullman, III and Kenneth H. Hannah are parties to the Marcus consolidated purported class action lawsuit in the U.S. District Court,

Eastern District of Texas, Tyler Division. The Marcus consolidated complaint is purportedly brought on behalf of persons who acquired our common stock

during the period from August 20, 2013 through September 26, 2013, and alleges claims for violations of Sections 10(b) and 20(a) of the Securities Exchange

Act of 1934 and Rule 10b-5 promulgated thereunder. Plaintiff claims that the defendants made false and misleading statements and/or omissions regarding

the Company’s financial condition and business prospects that caused our common stock to trade at artificially inflated prices. The consolidated complaint

seeks class certification, unspecified compensatory damages, including interest, reasonable costs and expenses, and other relief as the court may deem just

and proper. Defendants filed a motion to dismiss the consolidated complaint which was denied by the court on September 29, 2015. Defendants filed an

answer to the consolidated complaint on November 12, 2015. Plaintiff filed a motion for class certification on January 25, 2016.

Also, on August 26, 2014, plaintiff Nathan Johnson filed a purported class action lawsuit against the Company, Myron E. Ullman, III and Kenneth H. Hannah

in the U.S. District Court, Eastern District of Texas, Tyler Division. The suit is purportedly brought on behalf of persons who acquired our securities other

than common stock during the period from August 20, 2013 through September 26, 2013, generally mirrors the allegations contained in the Marcus lawsuit

discussed above, and seeks similar relief. On June 8, 2015, plaintiff in the Marcus lawsuit amended the consolidated complaint to include the members of the

purported class in the Johnson lawsuit, and on June 10, 2015, the Johnson lawsuit was consolidated into the Marcus lawsuit.

We believe these lawsuits are without merit and we intend to vigorously defend them. While no assurance can be given as to the ultimate outcome of these

matters, we believe that the final resolution of these actions will not have a material adverse effect on our results of operations, financial position, liquidity or

capital resources.

In October, 2013, two purported shareholder derivative actions were filed against certain present and former members of the Company’s Board of Directors

and executives by the following parties in the U.S. District Court, Eastern District of Texas, Sherman Division: Weitzman (filed October 2, 2013) and

Zauderer (filed October 3, 2013). The Company is named as a nominal defendant in both suits. The lawsuits assert claims for breaches of fiduciary duties and

unjust enrichment based upon alleged false and misleading statements and/or omissions regarding the Company’s financial condition. The lawsuits seek

unspecified compensatory damages, restitution, disgorgement by the defendants of all profits, benefits and other compensation, equitable relief to reform the

Company’s corporate governance and internal procedures, reasonable costs and expenses, and other relief as the court may deem just and proper. On October

28, 2013, the Court consolidated the two cases into the Weitzman lawsuit. On January 15, 2014, the Court entered an order staying the derivative suits

pending certain events in the class action securities litigation described above. While no assurance can be given as to the ultimate outcome of this matter, we

believe that the final resolution of this action will not have a material adverse effect on our results of operations, financial position, liquidity or capital

resources.

JCP and certain present and former members of JCP's Board of Directors have been sued in a purported class action complaint by plaintiffs Roberto Ramirez

and Thomas Ihle, individually and on behalf of all others similarly situated, which was filed on July 8, 2014 in the U.S. District Court, Eastern District of

Texas, Tyler Division. The suit alleges that the defendants violated Section 502 of the Employee Retirement Income Security Act (ERISA) by breaching

fiduciary duties relating to the J. C. Penney Corporation, Inc. Savings, Profit-Sharing and Stock Ownership Plan (the Plan). The class period is alleged to be

between November 1, 2011 and September 27, 2013. Plaintiffs allege that they and others who invested in or held Company stock in the Plan during this

period were injured because defendants allegedly made false and misleading statements and/or omissions regarding the Company’s financial condition and

business prospects that caused the Company’s common stock to trade at artificially inflated prices. The complaint seeks class certification, declaratory relief,

a constructive trust, reimbursement of alleged losses to the Plan, actual damages, attorneys’ fees and costs, and other relief. Defendants filed a motion to

dismiss the

99