JCPenney 2015 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2015 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

interim periods within those years, beginning after December 15, 2015. Early adoption is permitted. The Company early adopted ASU 2015-03

retrospectively in its second quarter ended August 1, 2015. As a result of the retrospective adoption, the Company reclassified unamortized debt issuance

costs of $95 million as of January 31, 2015 from Other assets to a reduction in Long-term debt in the Consolidated Balance Sheets. Adoption of this standard

did not impact results of operations, retained earnings, or cash flows in the current or previous interim and annual reporting periods.

In August 2014, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) 2014-15,

. This ASU requires

management to evaluate whether there are conditions or events that raise substantial doubt about the entity’s ability to continue as a going concern within

one year after the date that the financial statements are issued or are available to be issued. This ASU also requires management to disclose certain

information depending on the results of the going concern evaluation. The provisions of this ASU are effective for annual periods ending after December 15,

2016, and for interim and annual periods thereafter. Early adoption is permitted. This amendment is applicable to us beginning in the first quarter of 2017.

We do not expect the adoption of this standard to have a material impact on our financial condition, results of operations or cash flows.

In June 2014, the FASB issued ASU 2014-12, Compensation - Stock Compensation, an amendment to FASB Accounting Standards Codification (ASC) Topic

718,

. ASU 2014-12 requires that a performance target that affects vesting, and that could be achieved after the requisite service period, be treated as a

performance condition. As such, the performance target should not be reflected in estimating the grant date fair value of the award. This update is effective for

annual reporting periods beginning after December 15, 2015, with early adoption permitted. We do not expect the adoption of this standard to have a

material impact on our financial condition, results of operations or cash flows.

In May 2014, the FASB issued ASC Topic 606, . The new

revenue recognition standard provides a five-step analysis of transactions to determine when and how revenue is recognized. The core principle of the

guidance is that a Company should recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the

consideration to which the entity expects to be entitled in exchange for those goods or services. This standard is effective for us beginning in fiscal 2018 and

can be adopted by the Company either retrospectively or as a cumulative-effect adjustment as of the date of adoption. We are currently evaluating the effect

that adopting this new accounting guidance will have on our financial condition, results of operations or cash flows.

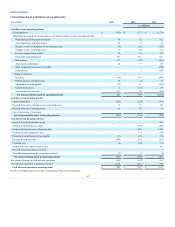

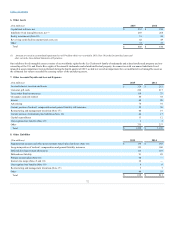

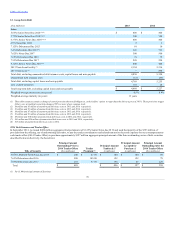

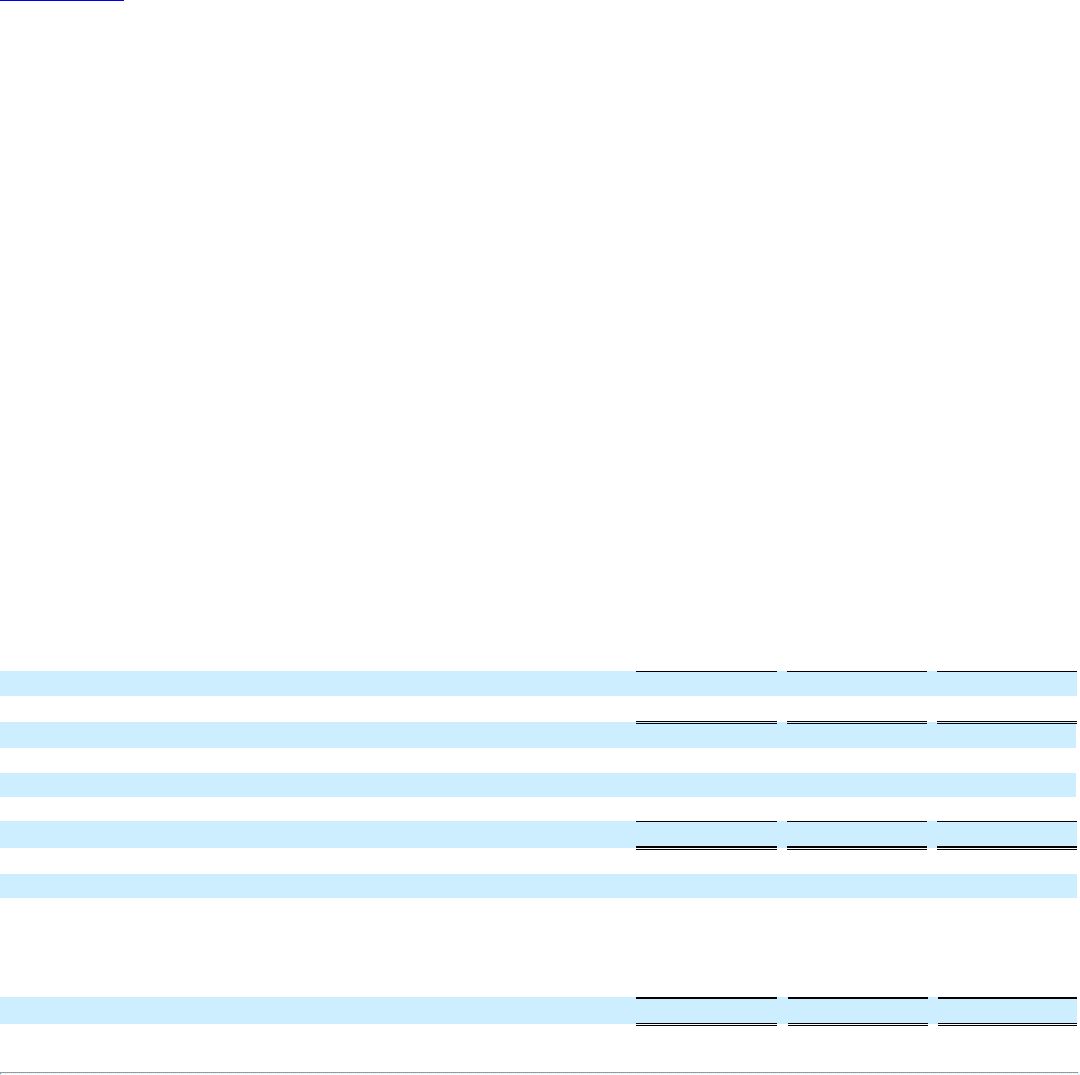

Net income/(loss) and shares used to compute basic and diluted EPS are reconciled below:

Net income/(loss)

$ (513)

$ (717)

$ (1,278)

Weighted average common shares outstanding (basic shares)

305.9

305.2

249.3

Adjustment for assumed dilution:

Stock options, restricted stock awards and warrant

—

—

—

Weighted average shares assuming dilution (diluted shares)

305.9

305.2

249.3

Basic

$ (1.68)

$ (2.35)

$ (5.13)

Diluted

$ (1.68)

$ (2.35)

$ (5.13)

The following average potential shares of common stock were excluded from the diluted EPS calculation because their effect would have been anti-dilutive:

Stock options, restricted stock awards and a warrant

34.1

26.8

24.3

71