JCPenney 2015 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2015 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

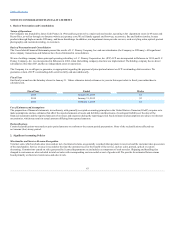

We use derivative financial instruments for hedging and non-trading purposes to manage our exposure to changes in interest rates. Use of derivative financial

instruments in hedging programs subjects us to certain risks, such as market and credit risks. Market risk represents the possibility that the value of the

derivative instrument will change. In a hedging relationship, the change in the value of the derivative is offset to a great extent by the change in the value of

the underlying hedged item. Credit risk related to derivatives represents the possibility that the counterparty will not fulfill the terms of the contract. The

notional, or contractual amount of our derivative financial instruments is used to measure interest to be paid or received and does not represent our exposure

due to credit risk. Credit risk is monitored through established approval procedures, including setting concentration limits by counterparty, reviewing credit

ratings and requiring collateral (generally cash) from the counterparty when appropriate.

When we use derivative financial instruments for the purpose of hedging our exposure to interest rates, the contract terms of a hedged instrument closely

mirror those of the hedged item, providing a high degree of risk reduction and correlation. Contracts that are effective at meeting the risk reduction and

correlation criteria are recorded using hedge accounting. If a derivative instrument is a hedge, depending on the nature of the hedge, changes in the fair value

of the instrument will either be offset against the change in fair value of the hedged assets, liabilities or firm commitments through earnings or be recognized

in accumulated other comprehensive income (loss) until the hedged item is recognized in earnings. The ineffective portion of an instrument’s change in fair

value will be immediately recognized in earnings during the period. Instruments that do not meet the criteria for hedge accounting, or contracts for which we

have not elected hedge accounting, are valued at fair value with unrealized gains or losses reported in earnings during the period of change.

Effective May 7, 2015, we entered into interest rate swap agreements with notional amounts totaling $1,250 million to fix a portion of our variable LIBOR-

based interest payments. The interest rate swap agreements have a weighted-average fixed rate of 2.04%, mature on May 7, 2020 and have been designated as

cash flow hedges.

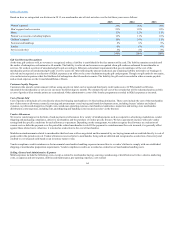

The fair value of our interest rate swaps are recorded in the Consolidated Balance Sheets as an asset or a liability (see Note 10). The effective portion of the

interest rate swaps' changes in fair values is reported in Accumulated other comprehensive income/(loss) (see Note 13), and the ineffective portion is reported

in Net income/(loss). Amounts in Accumulated other comprehensive income/(loss) are reclassified into net income/(loss) when the related interest payments

affect earnings. For the periods presented, all of the interest rate swaps were 100% effective.

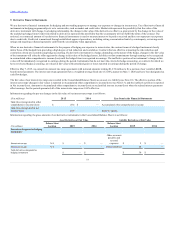

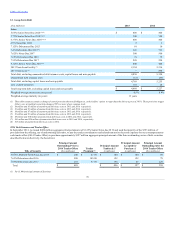

Information regarding the pre-tax changes in the fair value of our interest rate swaps is as follows:

Gain/(loss) recognized in other

comprehensive income/(loss) $ (38)

$ —

Accumulated other comprehensive income

Gain/(loss) recognized in net

income/(loss) (10)

—

Interest expense

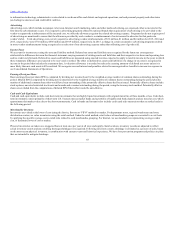

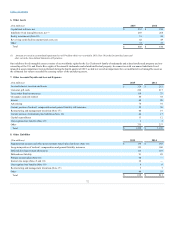

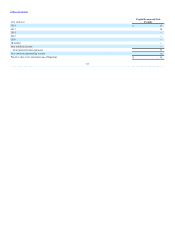

Information regarding the gross amounts of our derivative instruments in the Consolidated Balance Sheets is as follows:

Interest rate swaps N/A

$ —

$ —

Other accounts

payable and

accrued

expenses $ 2

$ —

Interest rate swaps N/A

—

—

Other liabilities 28

—

Total derivatives designated as

hedging instruments

$ —

$ —

$ 30

$ —

73