JCPenney 2015 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2015 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

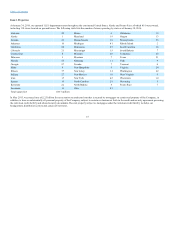

Table of Contents

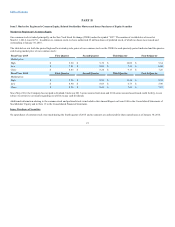

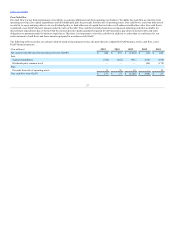

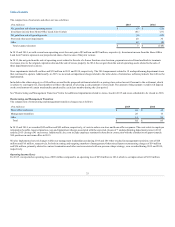

Beginning of year

1,062

1,094

1,104

1,102

1,106

Openings

—

1

—

9(1) 3

Closings

(41)

(33)

(10)

(7) (1) (7)

End of year

1,021

1,062

1,094

1,104

1,102

Gross selling space

104.7

107.9

110.6

111.6

111.2

Sales per gross square foot(2)

$ 120

$ 113

$ 107

$ 116

$ 154

Sales per net selling square foot(2)

$ 165

$ 155

$ 147

$ 161

$ 212

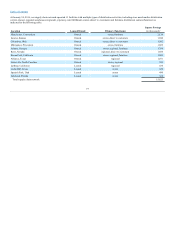

—

—

10

10

10

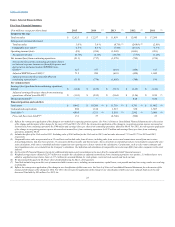

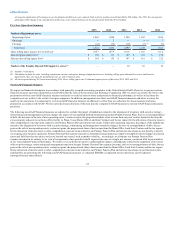

We report our financial information in accordance with generally accepted accounting principles in the United States (GAAP). However, we present certain

financial measures and ratios identified as non-GAAP under the rules of the Securities and Exchange Commission (SEC) to assess our results. We believe the

presentation of these non-GAAP financial measures and ratios is useful in order to better understand our financial performance as well as to facilitate the

comparison of our results to the results of our peer companies. In addition, management uses these non-GAAP financial measures and ratios to assess the

results of our operations. It is important to view non-GAAP financial measures in addition to, rather than as a substitute for, those measures and ratios

prepared in accordance with GAAP. We have provided reconciliations of the most directly comparable GAAP measures to our non-GAAP financial measures

presented.

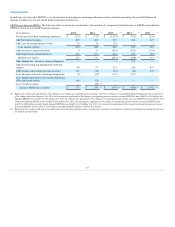

The following non-GAAP financial measures are adjusted to exclude the impact of markdowns related to the alignment of inventory with our prior strategy,

restructuring and management transition charges, the impact of our qualified defined benefit pension plan (Primary Pension Plan), the loss on extinguishment

of debt, the net gain on the sale of non-operating assets, certain net gains, the proportional share of net income from our joint venture formed to develop the

excess property adjacent to our home office facility in Plano, Texas (Home Office Land Joint Venture) and the tax impact for the allocation of income taxes to

other comprehensive income items related to our Primary Pension Plan and interest rate swaps. Unlike other operating expenses, the impact of the markdowns

related to the alignment of inventory with our prior strategy, restructuring and management transition charges, the loss on extinguishment of debt, the net

gain on the sale of non-operating assets, certain net gains, the proportional share of net income from the Home Office Land Joint Venture and the tax impact

for the allocation of income taxes to other comprehensive income items related to our Primary Pension Plan and interest rate swaps are not directly related to

our ongoing core business operations. Primary Pension Plan expense/(income) is determined using numerous complex assumptions about changes in pension

assets and liabilities that are subject to factors beyond our control, such as market volatility. Accordingly, we eliminate our Primary Pension Plan

expense/(income) in its entirety as we view all components of net periodic benefit expense/(income) as a single, net amount, consistent with its presentation

in our Consolidated Financial Statements. We believe it is useful for investors to understand the impact of markdowns related to the alignment of inventory

with our prior strategy, restructuring and management transition charges, Primary Pension Plan expense/(income), the loss on extinguishment of debt, the net

gain on the sale of non-operating assets, certain net gains, the proportional share of net income from the Home Office Land Joint Venture and the tax impact

for the allocation of income taxes to other comprehensive income items related to our Primary Pension Plan and interest rate swaps on our financial results

and therefore are presenting the following non-GAAP financial measures: (1) adjusted EBITDA; (2) adjusted net income/(loss); and (3) adjusted

earnings/(loss) per share-diluted.

24