JCPenney 2015 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2015 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

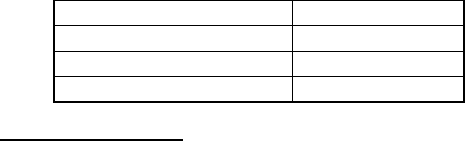

Vest Date Percent Vesting

Acceleration of Vesting

If Your employment terminates due to Retirement, Disability, or death

or you experience an Involuntary Separation from Service other than

for Cause as a result of a, job restructuring, reduction in force, or unit

closing before any applicable Vest date of your Non-Qualified Stock

Option, your Non-Qualified Stock Option will vest on a pro-rata basis.

The pro-rata portion of your Non-Qualified Stock Option that will vest

will be determined by multiplying the “Number of Stock Options

Granted” from above by a fraction, the numerator of which is the

number of months from the Grant Date to the effective date of your

termination of employment, inclusive, and the denominator of which is

36. The number of Non-Qualified Stock Options that have already

vested according to the terms herein, if any, will be subtracted from

the prorated amount and the remaining prorated Non-Qualified Stock

Options will become vested and immediately exercisable. Any Non-

Qualified Stock Options that have not already vested or for which

vesting is not accelerated will expire on such employment termination.

If you are party to a TPA, and you experience an Involuntary

Separation from Service without Cause under, and as defined in that

TPA (even if that Involuntary separation from Service without case is

a result of a, job restructuring, reduction in force, or unit closing), then

the number of Non-Qualified Stock Options that will vest and become

exercisable will be determined according to the terms of the underlying

TPA. If the applicable TPA calls for pro-rata vesting of this Non-

Qualified Stock Option then the pro-rata portion of your Non-Qualified

Stock Option that will vest will be determined by multiplying the

“Number of Stock Options Granted” from above by a fraction, the

numerator of which is the number of months from the Grant Date to

the effective date of your termination of employment, inclusive, and

the denominator of which is 36. The number of Non-Qualified Stock

Options that have already vested according to the terms herein, if

any, will be subtracted from the prorated amount and the remaining

prorated Non-Qualified Stock Options will become vested and

immediately exercisable.

If following a Change in Control You experience an Involuntary

Separation from Service other than for Cause or You voluntarily

terminate your employment for Good Reason, Your Non-Qualified

Stock Option will vest on a pro-rata basis. The pro-rata portion of your

Non-Qualified Stock Option that will vest will be determined by

multiplying the “Number of Stock Options Granted” from above by a

fraction, the numerator of which is the number of months from the

Grant Date to the effective date of your termination of Employment,

inclusive, and the denominator of which is 36. The number of Non-

Qualified Stock Options that have already vested according to the

terms herein, if any, will be subtracted from the prorated amount and

the remaining prorated Non-Qualified Stock Options will become

vested and immediately exercisable. Any Non-Qualified Stock Options

that have not already vested or for which vesting is not accelerated

will expire on such employment termination.

In the case of any Involuntary Separation from Service other than for

Cause, or, following a Change in Control, a voluntary termination of

your employment for Good Reason, the delivery of any Non-Qualified

Stock Options that vest in connection with such termination of

employment will be subject to (a) the execution and delivery of a

release in such form as may be required by the Company and (b) the

expiration of the applicable revocation period for such release.

If You voluntarily terminate your employment, other than a voluntary

termination of your employment for Good Reason following a Change

in Control, or You experience an Involuntary Separation from Service

for Cause then all vested but as yet unexercised and unvested Non-

Qualified Stock Options will be cancelled on the effective date of Your

employment termination as a result of the Involuntary Separation from

Service for Cause or Your resignation.