JCPenney 2015 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2015 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

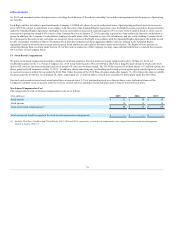

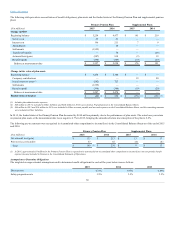

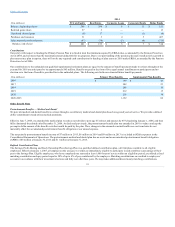

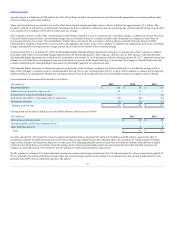

Cash

$ 10

$ 2

$ —

$ 12

Common collective trusts

—

38

—

38

Cash and cash equivalents total

10

40

—

50

Common collective trusts – domestic

—

222

—

222

Common collective trusts – international

—

197

—

197

Equity securities – domestic

733

—

—

733

Equity securities – international

104

—

—

104

Private equity

—

—

281

281

Equity securities total

837

419

281

1,537

Common collective trusts

—

1,695

—

1,695

Corporate bonds

—

1,319

7

1,326

Swaps

—

415

—

415

Government securities

—

167

—

167

Corporate loans

—

69

5

74

Municipal bonds

—

66

—

66

Mortgage backed securities

—

5

—

5

Other fixed income

—

21

—

21

Fixed income total

—

3,757

12

3,769

Public REITs

100

—

—

100

Private real estate

—

20

153

173

Real estate total

100

20

153

273

Hedge funds

—

—

314

314

Other investments total

—

—

314

314

Total investment assets at fair value

$ 947

$ 4,236

$ 760

$ 5,943

Swaps

$ —

$ (428)

$ —

$ (428)

Other fixed income

(2)

(3)

—

(5)

Fixed income total

(2)

(431)

—

(433)

Total liabilities at fair value

$ (2)

$ (431)

$ —

$ (433)

Accounts payable, net

(36)

Total net assets

$ 5,474

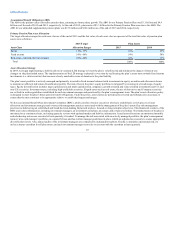

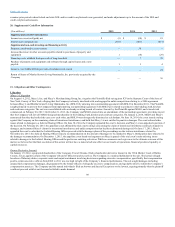

Following is a description of the valuation methodologies used for Primary Pension Plan assets measured at fair value.

– Cash is valued at cost which approximates fair value, and is classified as level 1 of the fair value hierarchy.

Common collective trusts are pools of investments within cash equivalents, equity and fixed income that are benchmarked

relative to a comparable index. They are valued on the basis of the relative interest of each participating investor in the fair value of the underlying assets.

The underlying assets are valued at net asset value (NAV) and are classified as level 2 of the fair value hierarchy.

Equity securities are common stocks and preferred stocks valued based on the price of the security as listed on an open active exchange

and classified as level 1 of the fair value hierarchy, as well as warrants and preferred stock that are valued at a price, which is based on a broker quote in an

over-the-counter market, and are classified as level 2 of the fair value hierarchy.

89