JCPenney 2015 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2015 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

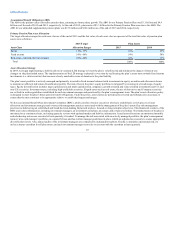

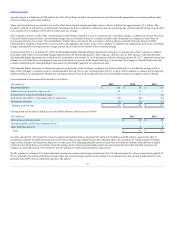

unrealized gross tax deduction of $24 million (tax effect $9 million) related to the implementation of share-based compensation accounting guidance that

will be recorded in equity when realized.

These carryforwards have a potential to be used to offset future taxable income and reduce future cash tax liabilities by approximately $1.1 billion. The

Company’s ability to utilize these carryforwards will depend upon the availability of future taxable income during the carryforward period and, as such, there

is no assurance the Company will be able to realize such tax savings.

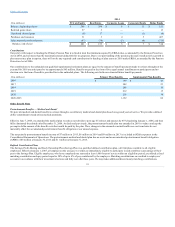

The Company’s ability to utilize NOL carryforwards could be further limited if it were to experience an “ownership change,” as defined in Section 382 of the

Code and similar state provisions. An ownership change can occur whenever there is a cumulative shift in the ownership of a company by more than 50

percentage points by one or more “5% stockholders” within a three-year period. The occurrence of such a change generally limits the amount of NOL

carryforwards a company could utilize in a given year to the aggregate fair market value of the company’s common stock immediately prior to the ownership

change, multiplied by the long-term tax-exempt interest rate in effect for the month of the ownership change.

As discussed in Note 13, on January 27, 2014, the Board adopted the Amended Rights Agreement to help prevent acquisitions of the Company’s common

stock that could result in an ownership change under Section 382 which helps preserve the Company’s ability to use its NOL and tax credit carryforwards.

The Amended Rights Agreement was ratified by the shareholder vote on May 16, 2014 and remains effective through January 26, 2017. Approval required an

affirmative vote of the shares of common stock present in person or by proxy at the Annual Meeting. At a later date, the Company’s Board of Directors may

consider resubmitting the Amended Rights Agreement for stockholder approval of a subsequent term.

The Amended Rights Agreement is designed to prevent acquisitions of the Company’s common stock that would result in a stockholder owning 4.9% or

more of the Company’s common stock (as calculated under Section 382), or any existing holder of 4.9% or more of the Company’s common stock acquiring

additional shares, by substantially diluting the ownership interest of any such stockholder unless the stockholder obtains an exemption from the Board.

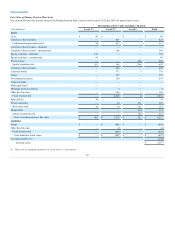

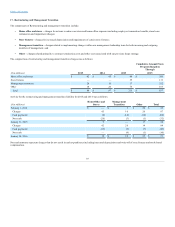

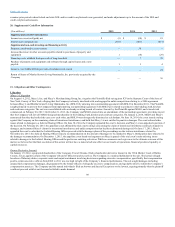

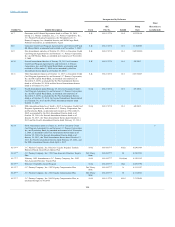

A reconciliation of unrecognized tax benefits is as follows:

Beginning balance

$ 62

$ 70

$ 76

Additions for tax positions of prior years

40

10

6

Reductions for tax positions of prior years

—

—

(1)

Settlements and effective settlements with tax authorities

(10)

(16)

(9)

Expirations of statute

(1)

(2)

(2)

Balance at end of year

$ 91

$ 62

$ 70

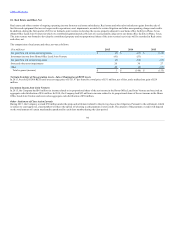

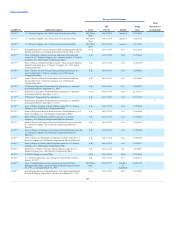

Unrecognized tax benefits included in our Consolidated Balance Sheets were as follows:

Deferred taxes (current assets)

$ 84

$ 49

Accounts payable and accrued expenses (Note 7)

3

5

Other liabilities (Note 8)

4

8

Total

$ 91

$ 62

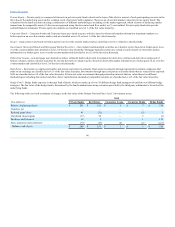

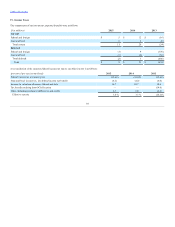

As of the end of 2015, 2014 and 2013, the unrecognized tax benefits balance included $33 million, $36 million and $49 million, respectively, that, if

recognized, would be a benefit in the income tax provision after giving consideration to the offsetting effect of $12 million, $13 million and $17 million,

respectively, related to the federal tax deduction of state taxes. The remaining amounts reflect tax positions for which the ultimate deductibility is highly

certain, but for which there is uncertainty about the timing. Accrued interest and penalties related to unrecognized tax benefits included in income tax

expense as of the end of 2015, 2014 and 2013 were $3 million, $3 million and $6 million, respectively.

We file income tax returns in U.S. federal and state jurisdictions and certain foreign jurisdictions. Our U.S. federal returns have been examined through 2012.

We are audited by the taxing authorities of many states and certain foreign countries and are subject to examination by these taxing jurisdictions for years

generally after 2008. The tax authorities may have the right to

97