JCPenney 2015 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2015 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

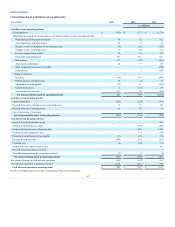

We use a consistent lease term when calculating amortization of leasehold improvements, determining straight-line rent expense and determining

classification of leases as either operating or capital. For purposes of recognizing incentives, premiums, rent holidays and minimum rental expenses on a

straight-line basis over the terms of the leases, we use the date of initial possession to begin amortization, which is generally when we take control of the

property. Renewal options determined to be reasonably assured are also included in the lease term. Some leases require additional payments based on sales

and are recorded in rent expense when the contingent rent is probable.

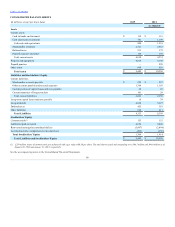

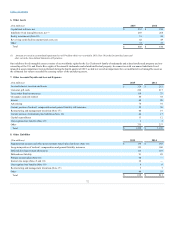

Some of our lease agreements contain developer/tenant allowances. Upon receipt of such allowances, we record a deferred rent liability in other liabilities on

the Consolidated Balance Sheets. The allowances are then amortized on a straight-line basis over the remaining terms of the corresponding leases as a

reduction of rent expense.

Costs associated with exit or disposal activities are recorded at their fair values when a liability has been incurred. Reserves for operating leases are

established at the time of closure for the present value of any remaining operating lease obligations (PVOL), net of estimated sublease income. Severance is

recorded over the service period required to be rendered in order to receive the termination benefits or, if employees will not be retained to render future

service, a reserve is established when communication has occurred to the affected employees. Other exit costs are accrued either at the point of decision or the

communication date, depending on the nature of the item.

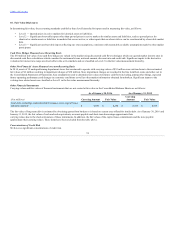

We recognize the funded status – the difference between the fair value of plan assets and the plan’s benefit obligation – of our defined benefit pension and

postretirement plans directly on the Consolidated Balance Sheet. Each overfunded plan is recognized as an asset and each underfunded plan is recognized as

a liability. We adjust other comprehensive income/(loss) to reflect prior service cost or credits and actuarial gain or loss amounts arising during the period

and reclassification adjustments for amounts being recognized as components of net periodic pension/postretirement cost, net of tax. Prior service cost or

credits are amortized to net income/(loss) over the average remaining service period, a period of about eight years for the primary plan. Pension related

actuarial gains or losses in excess of 10% of the greater of the fair value of plan assets or the plan's projected benefit obligation (the corridor) are recognized

annually in the fourth quarter each year (Mark-to-market (MTM) adjustment), and, if applicable, in any interim period in which an interim remeasurement is

triggered. See Note 3 for the discussion of the accounting change related to our retirement-related benefits.

We measure the plan assets and obligations annually at the adopted measurement date of January 31 to determine pension expense for the subsequent year.

The factors and assumptions affecting the measurement are the characteristics of the population and salary increases, with the most important being the

expected return on plan assets and the discount rate for the pension obligation. We use actuarial calculations for the assumptions, which require significant

judgment.

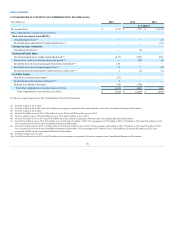

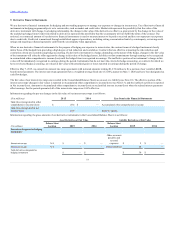

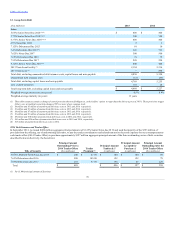

Stock options are valued primarily using the binomial lattice option pricing model and are granted with an exercise price equal to the closing price of our

common stock on the grant date. Time-based and performance-based restricted stock awards are valued using the closing price of our common stock on the

grant date. For awards that have market conditions, such as attaining a specified stock price or based on total shareholder return, we use a Monte Carlo

simulation model to determine the value of the award. Our current plan does not permit awarding stock options below grant-date market value nor does it

allow any repricing subsequent to the date of grant.

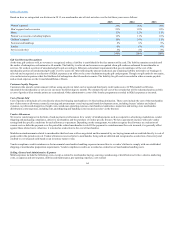

Stock options are valued using the following assumptions:

We estimate the fair value of stock option awards on the date of grant using primarily the binomial lattice model. We believe that

the binomial lattice model is a more accurate model for valuing employee stock options since it better reflects the impact of stock price changes on

option exercise behavior.

Our expected option term represents the average period that we expect stock options to be outstanding and is determined based on

our historical experience, giving consideration to contractual terms, vesting schedules, anticipated stock prices and expected future behavior of

option holders.

Our expected volatility is based on a blend of the historical volatility of JCPenney stock combined with an estimate of the

implied volatility derived from exchange traded options.

67