JCPenney 2015 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2015 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

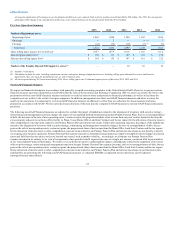

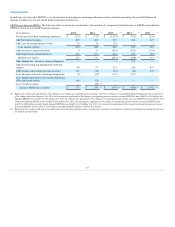

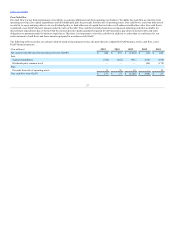

The following discussion, which presents our results, should be read in conjunction with the accompanying Consolidated Financial Statements and notes

thereto, along with the Five-Year Financial and Operations Summaries, the risk factors and the cautionary statement regarding forward-looking information.

Unless otherwise indicated, all references in this Management’s Discussion and Analysis (MD&A) related to earnings/(loss) per share (EPS) are on a diluted

basis and all references to years relate to fiscal years rather than to calendar years.

Our strategic framework is built upon the three pillars of private brands, omnichannel and revenue per customer.

Product differentiation, affordable style and quality and enhanced profitability are critical to the success of our private brands. With our team of designers

and our proprietary designs, we believe we can differentiate our private and exclusive brands from our competitors and the overall marketplace. Through our

private brand selection, we believe we can provide value to our customers by offering products with style and quality at an attractive price point. Lastly, with

our global sourcing infrastructure, we believe we are uniquely positioned to enhance our merchandise margins by managing product development costs and

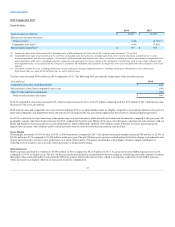

maintaining flexibility with our price offerings. During 2015, private brand merchandise comprised 44% of total merchandise sales, as compared to 42% and

41% in 2014 and 2013, respectively. During 2015, 2014 and 2013, exclusive brand merchandise comprised 8%, 11% and 11%, respectively, of total

merchandise sales.

Our second strategic area of focus is omnichannel. With our heritage of being a catalog retailer, we believe we have the right foundation in place to enhance

our omnichannel capabilities. Today’s customer wants to decide when and how she wants to shop, whether in store or online using multiple personal devices.

Improving the omnichannel experience for our customers involves further development of our mobile apps, providing more fulfillment choices to the

customer and expanding our merchandise assortment. In 2015, we made significant improvements to our mobile app and began testing “buy online and pick

up in store same day.” We also intend to continue to expand our online assortment to increase sales and differentiate ourselves from pure e-commerce

competitors.

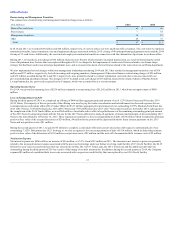

Our final strategic priority is revenue per customer. For 2016, we are focused on three initiatives to increase the frequency and amount customers spend on

every transaction. First, we plan to accelerate our growth of Sephora inside JCPenney locations. In 2015, we opened 28 additional Sephora locations,

bringing our total number of locations to 518, and introduced a selection of Sephora makeup, skincare and fragrance products to jcpenney.com. We plan to

add approximately 60 new Sephora locations in 2016. Second, we continue to enhance our salon environment through our rebranding initiative in

partnership with InStyle magazine. Third, for 2016 we plan to redesign the center core area, which includes fashion and fine jewelry, handbags, footwear,

sunglasses, and accessories, in approximately one-third of our stores.

28