JCPenney 2015 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2015 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

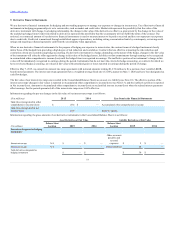

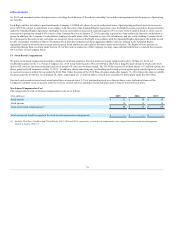

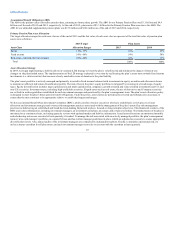

We paid approximately $362 million aggregate consideration, including $6 million of accrued interest, for the accepted Securities in October 2014. The

2014 Tender Offers resulted in a loss on extinguishment of debt of $30 million which includes the premium paid over face value of the accepted Securities of

$29 million and reacquisition costs of $1 million.

In October 2014, subsequent to the completion of the 2014 Tender Offers, we deposited approximately $64 million with Wilmington Trust, National

Association, as Trustee under the Indenture with respect to our 6.875% Medium-Term Notes due 2015 (2015 Notes), to effect a legal defeasance of the

remaining outstanding principal amount of 2015 Notes. As a result of depositing funds with the Trustee sufficient to make all payments of interest and

principal on the outstanding 2015 Notes through October 15, 2015, the stated maturity of the 2015 Notes, the Company has satisfied and discharged all of its

obligations under the terms of the 2015 Notes and with respect to the 2015 Notes under the Indenture. The defeasance resulted in a loss on extinguishment of

debt of $4 million which represents the portion of the deposited funds for future interest payments on the 2015 Notes.

In 2013, JCP entered into a $2.25 billion five-year senior secured term loan facility (2013 Term Loan Facility). The 2013 Term Loan Facility is guaranteed by

J. C. Penney Company, Inc. and certain subsidiaries of JCP, and is secured by mortgages on certain real estate of JCP and the guarantors, in addition to

substantially all other assets of JCP and the guarantors. The 2013 Term Loan Facility bears interest at a rate of LIBOR plus 5.0%. We are required to make

quarterly repayments in a principal amount equal to $5.625 million during the five-year term, subject to certain reductions for mandatory and optional

prepayments.

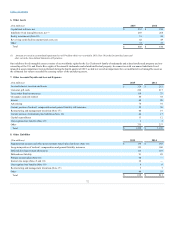

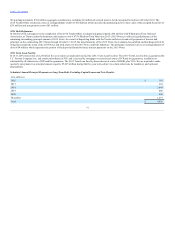

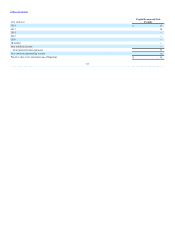

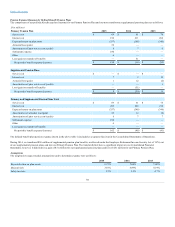

2016 $ 101

2017 243

2018 2,449

2019 400

2020 400

Thereafter 1,237

Total $ 4,830

77