JCPenney 2015 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2015 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

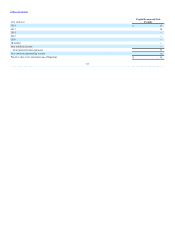

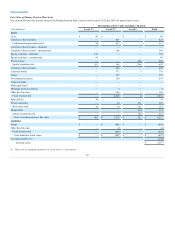

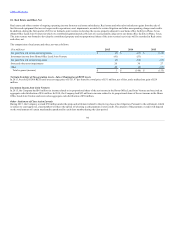

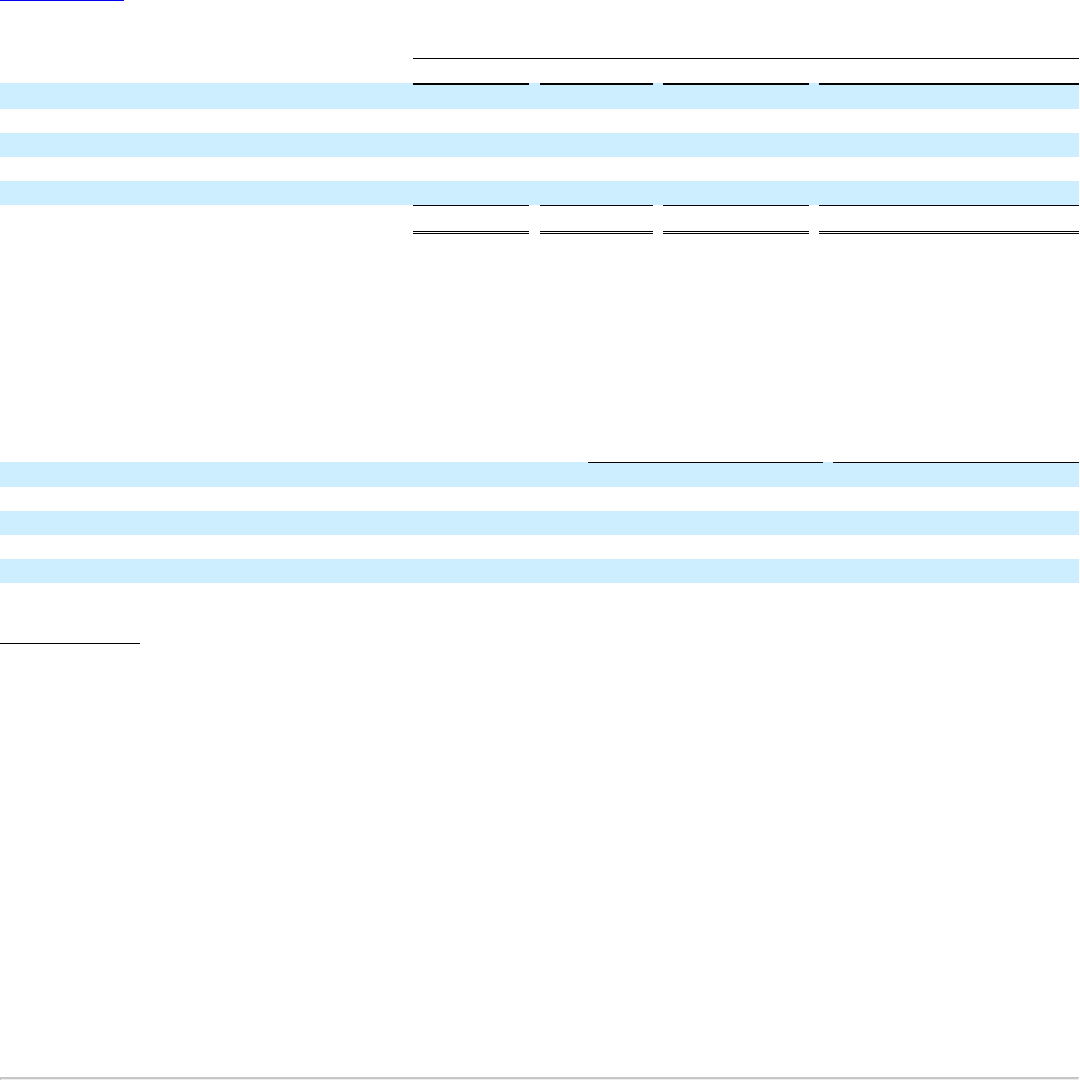

Balance, beginning of year $ 298

$ 204

$ 6

$ 11

$ 153

Realized gains/(loss) 57

3

—

—

13

Unrealized (losses)/gains (8)

17

—

(1)

(4)

Purchases and issuances 31

3

4

5

467

Sales, maturities and settlements (97)

(74)

(5)

(8)

(315)

Balance, end of year $ 281

$ 153

$ 5

$ 7

$ 314

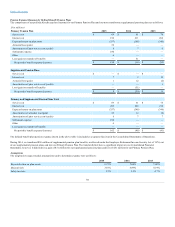

Our policy with respect to funding the Primary Pension Plan is to fund at least the minimum required by ERISA rules, as amended by the Pension Protection

Act of 2006, and not more than the maximum amount deductible for tax purposes. Due to our past funding of the pension plan and overall positive growth in

plan assets since plan inception, there will not be any required cash contribution for funding of plan assets in 2016 under ERISA, as amended by the Pension

Protection Act of 2006.

Our contributions to the unfunded non-qualified supplemental retirement plans are equal to the amount of benefit payments made to retirees throughout the

year and for 2016 are anticipated to be approximately $45 million. Benefits are paid in the form of five equal annual installments to participants and no

election as to the form of benefit is provided for in the unfunded plans. The following sets forth our estimated future benefit payments:

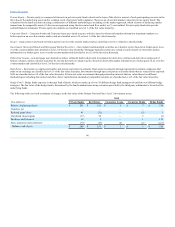

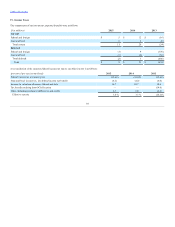

2016

$ 199

$ 45

2017

202

23

2018

206

16

2019

212

15

2020

216

14

2020-2025

1,152

66

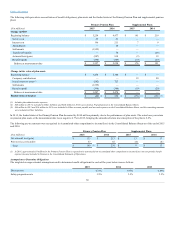

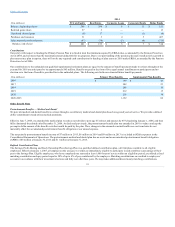

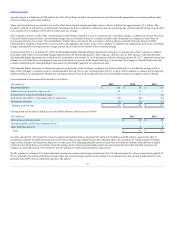

We provide medical and dental benefits to retirees through a contributory medical and dental plan based on age and years of service. We provide a defined

dollar commitment toward retiree medical premiums.

Effective June 7, 2005, we amended the medical plan to reduce our subsidy to post-age 65 retirees and spouses by 45% beginning January 1, 2006, and then

fully eliminated the subsidy after December 31, 2006. As disclosed previously, the postretirement benefit plan was amended in 2001 to reduce and cap the

per capita dollar amount of the benefit costs that would be paid by the plan. Thus, changes in the assumed or actual health care cost trend rates do not

materially affect the accumulated postretirement benefit obligation or our annual expense.

The net periodic postretirement benefit income of $7 million in 2015, $8 million in 2014 and $8 million in 2013 is included in SG&A expenses in the

Consolidated Statements of Operations. The postretirement medical and dental plan has no assets and an accumulated postretirement benefit obligation

(APBO) of $8 million at January 30, 2016 and $11 million at January 31, 2015.

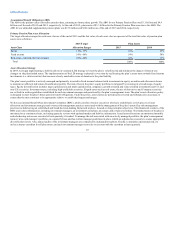

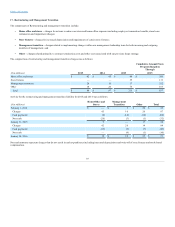

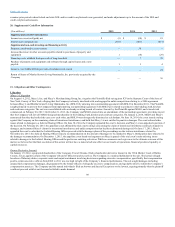

The Savings, Profit-Sharing and Stock Ownership Plan (Savings Plan) is a qualified defined contribution plan, a 401(k) plan, available to all eligible

employees. Effective January 1, 2007, all employees who are age 21 or older are immediately eligible to participate in and contribute a percentage of their

pay to the Savings Plan. Eligible employees, who have completed one year and at least 1,000 hours of service within an eligibility period, are offered a fixed

matching contribution each pay period equal to 50% of up to 6% of pay contributed by the employee. Matching contributions are credited to employees’

accounts in accordance with their investment elections and fully vest after three years. We may make additional discretionary matching contributions.

91