JCPenney 2015 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2015 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

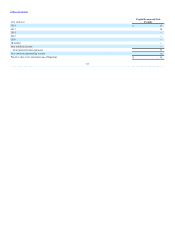

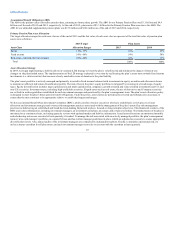

26, 2017 and amended certain other provisions, including the definition of "beneficial ownership" to include terms appropriate for the purpose of preserving

tax benefits.

Each Right entitles its holder to purchase from the Company 1/1000th of a share of a newly authorized series of participating preferred stock at an exercise

price of $55.00, subject to adjustment in accordance with the terms of the Amended Rights Agreement, once the Rights become exercisable. In general terms,

under the Amended Rights Agreement, the Rights become exercisable if any person or group acquires 4.9% or more of the Common Stock or, in the case of

any person or group that owned 4.9% or more of the Common Stock as of January 27, 2014, upon the acquisition of any additional shares by such person or

group. In addition, the Company, its subsidiaries, employee benefit plans of the Company or any of its subsidiaries, and any entity holding Common Stock

for or pursuant to the terms of any such plan, are excepted. Upon exercise of the Right in accordance with the Amended Rights Agreement, the holder would

be able to purchase a number of shares of Common Stock from the Company having an aggregate market value (as defined in the Amended Rights

Agreement) equal to twice the then-current exercise price for an amount in cash equal to the then-current exercise price. The Rights will not prevent an

ownership change from occurring under Section 382 of the Code or a takeover of the Company, but may cause substantial dilution to a person that acquires

4.9% or more of our Common Stock.

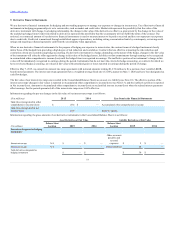

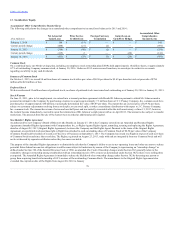

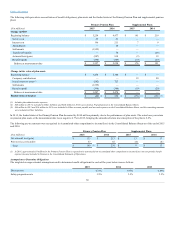

We grant stock-based compensation awards to employees and non-employee directors under our equity compensation plan. On May 16, 2014, our

stockholders approved the J. C. Penney Company, Inc. 2014 Long-Term Incentive Plan (2014 Plan), which has a fungible share design in which each stock

option will count as one share issued and each stock award will count as two shares issued. The 2014 Plan reserved 16 million shares or 32 million options for

future grants and will terminate on May 31, 2019. In addition, shares underlying any outstanding stock award or stock option grant canceled prior to vesting

or exercise become available for use under the 2014 Plan. Under the terms of the 2014 Plan, all grants made after January 31, 2014 reduce the shares available

for grant under the 2014 Plan. As of January 30, 2016, a maximum of 11.5 million shares of stock were available for future grant under the 2014 Plan.

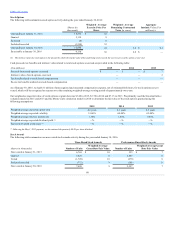

Our stock option and restricted stock award grants have averaged about 2.3% of outstanding stock over the past three years. Authorized shares of the

Company's common stock are used to settle the exercise of stock options, granting of restricted shares and vesting of restricted stock units.

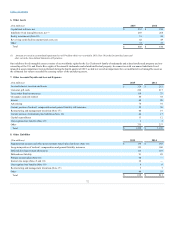

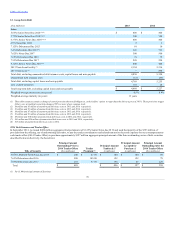

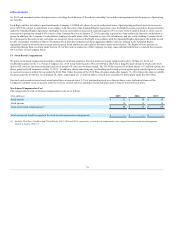

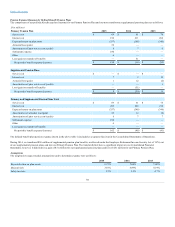

The components of total stock-based compensation costs are as follows:

Stock awards $ 32

$ 20

$ 14

Stock options 12

13

14

Total stock-based compensation(1) $ 44

$ 33

$ 28

Total income tax benefit recognized for stock-based compensation arrangements $ —

$ —

$ —

79