JCPenney 2015 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2015 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

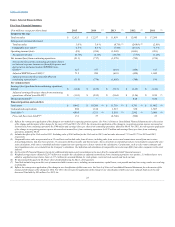

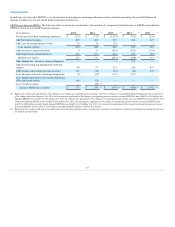

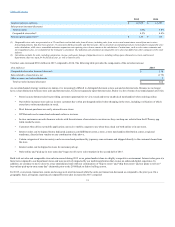

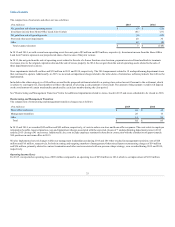

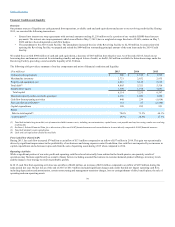

Sales were $12,625 million, an increase of 3.0% as compared to 2014, and comparable store sales increased 4.5%.

▪ Gross margin as a percentage of sales was 36.0% compared to 34.8% last year. The increase in gross margin as a percentage of sales is primarily due

to improved margins on our clearance merchandise.

▪ Selling, general and administrative (SG&A) expenses decreased $218 million, or 5.5%, as compared to 2014.

▪ Our net loss was $513 million, or $1.68 per share, compared to a net loss of $717 million, or $2.35 per share, in 2014. Results for 2015 included the

following amounts that are not directly related to our ongoing core business operations:

▪ $84 million, or $0.27 per share, of restructuring and management transition charges;

▪ $180 million, or $0.59 per share, for the impact related to the settlement of a portion of the Primary Pension Plan obligation;

▪ $10 million, or $0.03 per share, for the loss on extinguishment of debt;

▪ $9 million, or $0.03 per share, for the net gain on the sale of non-operating assets; and

▪ $41 million, or $0.13 per share, for our proportional share of net income from our joint venture formed to develop the excess property

adjacent to our home office facility in Plano, Texas (Home Office Land Joint Venture).

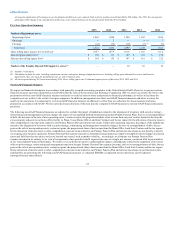

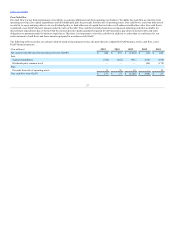

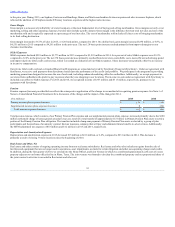

▪ We elected to change our method of recognizing pension expense. Previously, for the primary and supplemental pension plans, net actuarial gains or

losses in excess of 10% of the greater of the fair value of plan assets or the plans’ projected benefit obligation (the corridor) were recognized over the

remaining service period of plan participants (eight years for the Primary Pension Plan). Under the new accounting method, we recognize changes in

net actuarial gains or losses in excess of the corridor annually in the fourth quarter each year (Mark-to-market (MTM) Adjustment).

▪ EBITDA was $527 million for 2015, an improvement of $150 million compared to EBITDA of $377 million in 2014. Adjusted EBITDA was $715

million for 2015 compared to adjusted EBITDA of $280 million in 2014.

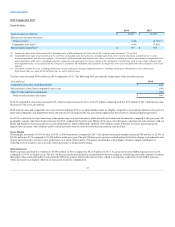

▪ On August 1, 2015, Marvin R. Ellison succeeded Myron E. Ullman, III as CEO of the Company. At that time, Mr. Ullman became Executive

Chairman of the Board of Directors.

▪ On December 10, 2015, J. C. Penney Company, Inc., JCP and J. C. Penney Purchasing Corporation (Purchasing) amended the Company's senior

secured asset-based credit facility (2014 Credit Facility) to increase the revolving line of credit under the facility (Revolving Facility) to $2,350

million. In connection with upsizing the Revolving Facility, we prepaid and retired the outstanding principal amount of the $500 million term loan

under the facility.

29